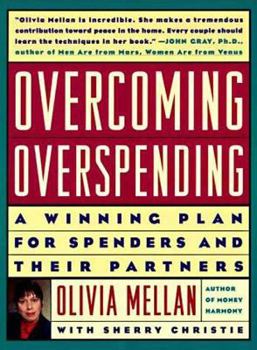

Overcoming Overspending: A Winning Plan for Spenders and Their Partners

Select Format

Select Condition

Book Overview

Do you or someone you love have trouble saying no when the urge to spend strikes? Are you always living on the edge financially, because your intention to save money is never as strong as your... This description may be from another edition of this product.

Format:Paperback

Language:English

ISBN:0802774954

ISBN13:9780802774958

Release Date:October 1997

Publisher:Walker Books

Length:160 Pages

Weight:0.58 lbs.

Dimensions:0.6" x 6.1" x 9.0"

Customer Reviews

5 ratings

Simply a classic, now updated!

Published by Thriftbooks.com User , 15 years ago

In this updated version of Overcoming Overspending: A Winning Plan for Spenders and their Partners, Olivia has continued her pioneering work in money psychology, and has made an invaluable contribution to the lives of overspenders, whether single or in relationships. Over the years, I've used several of her techniques with overshoppers with great success and I'd recommend this book to anyone struggling with overspending. A welcome addition is her greatly expanded list of references and resources. -April Lane Benson, Ph.D.,author, To Buy or Not to Buy: Why We Overshop and How to Stop

The book for these rough economic times

Published by Thriftbooks.com User , 15 years ago

For those who are having trouble saving enough and are stressed by their bills, this book will be a great help. If your spouse is an overspender, this book provides effective and well thought out strategies for you to communicate with them, for the benefit of both of you. With life expectancies increasing and high medical expenses, few have enough of a nest egg, making her message doubly important. As a financial advisor for over 25 years, I recommend without reservation that you buy her book today and read it twice, marking it up with notes and applying her message to your everday life.

Look back to look forward.

Published by Thriftbooks.com User , 17 years ago

Authors who write about debt and getting out of it, overspending and overcoming it, tend to fall into two categories: there is the P.E. coach who is going to whip you into shape, shout to you that you can do one more crunch, and perhaps throttle you if you screw up. Then there are the understanding therapists who want to help you understand the source of your compulsion and assemble around you a small team of trusted advocates who will stick with you through your relapses and help you to get well. Olivia Mellan is a therapist. Her book declares that upfront, so I am hardly outing a softy with this observation. If you want somebody to threaten your feeble, self-loathing little overspending life with an early demise if you don't cut up that last credit card, this book is not for you. But if you want somebody who understands you or your overspending partner, Mellan's Overcoming Overspending may be the one. You may need to supplment it, however, with something a bit more stern. Mellan herself is a `recovering overspender', 12-Step language that alerts you to the origin of her interest in this topic and the remedies she'll propose. Where others will begin with lurid descriptions of the living hell that absorbs the indebted masses--I do not intend to make light of this society-wide but deeply personal ill--Mellan's first chapter is entitled `What is Overspending All About?' In my judgement, her strong suit is probing gently at the scarcity of soul that generates overspending as a futile attempt to fill the void. Her second section is perhaps even more collegial: `How Spenders' Partners Can Help', followed by `Tools and Techniques You Both Can Use'. Pay attention to these section titles, since Mellan (or her editor) is what I call an `Honest Titler'. The names of her sections and chapters tell you exactly what to expect. Significantly, it is not until the book's fourth of five chapters that we read `How Overspenders Can Overcome', a remarkable postponement--though not an evasion--of the spender's responsibility. This is a classic therapeutic approach and may well be what you and your partner need. The final section--`The Long and Winding Road'--suggests that you'll suffer relapses along the way but you'll get to your destination if you and your partner keep at it. Given the sea of get-out-of-debt literature that is available, what ought we to make of Mellan's opportunity. I consider it a valuable tool for those who love an overspender, less so for the overspender himself or herself. Mellan is particularly good on what `hoarders' bring to the mix and how the overspender's partner is likely to change in order to compensate for the compulsion that comes here under review. The overspender will benefit from reading Overcoming Overspending, but is likely to need some backbone from a supplementary work.

Wise advice from a compassionate expert

Published by Thriftbooks.com User , 20 years ago

The reader who said the exercises in "Overcoming Overspending" are ridiculous does not want to examine his/her feelings about money. I have worked on many of the exercises and have found them enormously helpful with my own compulsive spending issues. Overspending is such a widespread problem now that a number of useful books have been written on the subject. Olivia Mellan's book shows gives readers the benefit of her years as a professional money counselor. Readers will find it well worth their time and thoughtful contemplation.

Excellent!

Published by Thriftbooks.com User , 20 years ago

I can't say enough good things about this book. It has helped my husband and me enormously. But for the book to work, I think you have to truly want to change your spending habits as individuals and as a couple and commit to the exercises. Skimming it (as the reviewer below did, to his or her disappointment) and hoping for magic is not going to bring about change. Let me just give a couple of examples from our experience with the book .... For my wonderful husband (a classic overspender) and me (a chronic underspender aka penny pincher), money was the one thing we argued about. I dreaded Christmas because my husband would buy loads of expensive presents, certainly many more than I wanted--and we'd spend the months after paying off debts. He tended to make impulsive purchases and frequently ate out. Over time, with the help of this wise book, we learned to make changes and capitalize on our strengths as a couple. I took over financial matters, we set up a budget, we commited to savings, we considered purchases carefully and went into stores at Christmas with a list to avoid impulsive purchases. Most importantly we learned how our childhoods, especially the models of our own parents, contributed to our present money woes. Getting a handle on our money issues, helped us move forward in other areas of our lives: having a child and considering adopting another, buying a new car, investing, saving for a house. So the book does work--if you're willing to invest the effort to change!