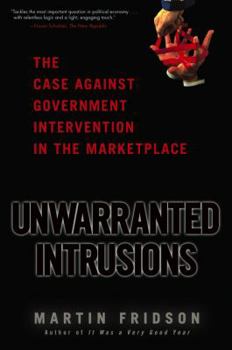

Unwarranted Intrusions: The Case Against Government Intervention in the Marketplace

What happens when politicians substitute their wisdom for the market's? The result is usually a government subsidy that provides advantage to a special interest group only-but costs everyone and... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0471687138

ISBN13:9780471687139

Release Date:May 2006

Publisher:Wiley

Length:309 Pages

Weight:0.70 lbs.

Dimensions:1.1" x 6.7" x 9.2"

Customer Reviews

5 ratings

Outstanding presentation of governmental economic nonsense

Published by Thriftbooks.com User , 17 years ago

I agree with nearly everything that the author says. His arguments against the economic effectiveness of government subsidies and intervention in the markets appeal to my libertarian streak and it is well known that many (most?) of the government programs are economically counterproductive. Some are downright silly. One of the most ridiculous, primarily because it went all the way to the United States Supreme Court, is the case of Karen Finley. She was an "artist" whose primary area of expertise was smearing her naked body with food. In special instances, she raised money by having people pay to lick the food, primarily chocolate, off her body. When her NEA grant application was rejected, Finley sued. So silly, yet so significant. For the real issue was twofold. *) Should the federal government use tax money to fund art? *) If the answer to the first question is yes, what are the bounds on the art? And this also raises a more general question concerning the use of public money to benefit small groups, the often-reviled "special interests." For if the federal government could not stop funding the fringe artists, there is no hope of stopping the real expensive cases of corporate welfare. One of the greatest is the enormous subsidy paid to American farmers to raise surplus food. Not only is it an expensive and deceptive program, it helps to keep subsistence farmers in other countries in poverty. As Fridson points out, while politicians demand that the program be kept alive to preserve the family farm, the reality is that there really is no such thing anymore. Billions of dollars in payments go to large corporate farms, which are the only ones that can grow the cheap food demanded by society at a price that it will accept. The hidden costs paid by the generic taxpayer are rarely factored in, and when they are they are conveniently ignored by the policy makers. Fridson also debunks the so-called "ethanol solution." Namely, take all of the surplus corn, convert it into ethanol, use it as fuel for automobiles and free the United States from having to import foreign oil. Tax credits and other gifts are used to promote the use of ethanol, with the thought being that farm prices will rise. The reality is that the farmer gets very little of the benefit, the bulk going to the distiller and the retailer. In fact, a Department of Energy estimate stated that every extra dollar of farm income from the use of ethanol costs the taxpayer four. Furthermore, since it takes more energy to produce a gallon of ethanol than can be retrieved from using it, ethanol may actually increase the dependence on foreign oil. Finally, in my home state of Iowa, the bumper stickers praise the use of ethanol, as it is touted as a fuel that burns cleaner. This "fact" has been refuted, although ethanol has some advantages, the different disadvantages mean that overall it pollutes as much as the burning of fossil fuels. Where I disagree with Fridson is in his unwavering belief i

What She Said

Published by Thriftbooks.com User , 17 years ago

Check out Dr Trixie above. Then read the book--after you buy it. Then check out the rest of the works of Fridson, as clear a writer on finance and political economy as there is. Blessed with ironic detachment from and a forgiving heart for the stupid and greedy who make our policies and populate our markets.

Great book!

Published by Thriftbooks.com User , 18 years ago

Great text from Fridson - a must-read for anyone with any interest in the inner workings of the U.S. government's involvement in economy. Fridson exposes inefficiencies all over the place without sparing either side of the aisle. The writing is well-versed, but at the same time extremely easy to follow.

Stick It Where It Hurts

Published by Thriftbooks.com User , 18 years ago

Citizens, rejoice! Marty Fridson, the D'Artagnan of finance, is back with his sharp and delicate sword, this time taking on the world of subsidy. Fridson is the eminently readable writer, historian, and Wall Street financial whiz whose books "It Was A Very Good Year" and "How To Be A Billionaire" offer wicked glimpses into the world of wealth accumulation, happily skewering the institutions from which all our rich fantasies spring. He now takes aim at the perennial use of government (read taxpayers') money to support troubled and misguided programs - Social Security! The FDIC! Fannie Mae! - which, he says, are better off left to the self-correcting forces of the marketplace. Fridson gives lucid histories of government intervention - starting in 1867 with campaign-finance reform - showing that regulations and subsidized programs, dear to our hearts and psyches, that were created to reduce disparities in wealth and income, have generally achieved the opposite effect. Politically-motivated bailouts -- aid to farmers, rent control, and property tax breaks for businesses -- create artificial shortages and gluts, making some people (usually the upper tax brackets: agribusiness, landlords, and CEOs) better off, at the cost of making everyone else worse - locally and globally. And the only people these subsidies invariably benefit are the politicians, who promote them to grease whichever wheel of the voters' cart is squeaking the loudest. Market failure in any sector means disparity: goods and services are not allocated efficiently. Fridson says that government intervention in the economy is only appropriate when the market fails to produce an optimal outcome - in education, for example, where the need for skilled workers outweighs individuals' demands. Direct income support is also necessary for workers who can't find employment, or who are unable to participate in the labor market. But other subsidies, protections, and regulations (like restrictions on short-selling and margin buying, or federal assistance to the big mortgage lenders, Fannie Mae and Freddie Mac) generally benefit the privileged (brokers; middle- and upper-income home buyers), exclude low-to-moderate-income groups, and contribute to the sequestration of capital in the top ten percent. Fridson provides plenty of credible, readable data to back his points. "Unwarranted Intrusions" is so sharp that it's painless; this book makes reading the political news fun again. Buy two copies - one for yourself and one for your favorite Congressperson.

Excellent primer on government's negative role in society

Published by Thriftbooks.com User , 18 years ago

Fridson is amazing. The research here is exhaustive, but at the same time highly accessible and enlightening. Fridson quotes everyone from classical economists such as Ricardo to contemporary politicians in showing how unwarranted intrusions by the government into our lives invariably makes us much worse off. For those who love to debate, this book is a must. Fridson uncovers the various myths about Ethanol, payola, and our "low" savings rate. An essential book.