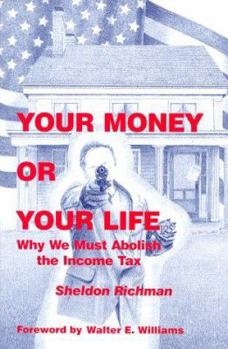

Your Money or Your Life: Why We Must Abolish the Income Tax

Select Format

Select Condition

Book Overview

The income tax wasn't integral to anything the Founders of this country had in mind and it wasn't integral to anything they designed. Your Money or Your Life: Why We Must Abolish the Income Tax shows... This description may be from another edition of this product.

Format:Paperback

Language:English

ISBN:096404479X

ISBN13:9780964044791

Release Date:January 1999

Publisher:Future of Freedom Foundation

Length:112 Pages

Weight:0.60 lbs.

Dimensions:0.3" x 5.9" x 8.9"

Customer Reviews

5 ratings

Don't replace it -- repeal it!

Published by Thriftbooks.com User , 16 years ago

The framers gave us a republic that held the government in check for over 100 years -- and Americans flourished like no other society in history. Then in 1913 we changed directions. Government teamed up with various factions and claimed ownership of our income, through the Sixteenth Amendment. The income tax required a menacing collection agency, the IRS, through which we've lost not only our property but our privacy. For years, many people have clamored for fundamental reform, suggesting "remedies" like a flat tax or a national sales tax. But reform is a politician's game, argues Sheldon Richman in "Your Money or Your Life." The only cure for the abuse is to abolish the income tax and replace it with nothing. The income tax -- or any other draconian tax -- creates permanent antagonism between taxpayers and government. Knowing this, and "wanting to milk [taxpayers] to the maximum without setting off a revolt," government tries to deaden the pain of theft through the ingenious device of tax withholding. For the past 65 years, withholding has helped drive home the idea that government owns our income. How can it be our property if someone else dictates its distribution? It's also prevented taxpayers from holding back their taxes as a form of protest. When Congress enacted the income tax law in October, 1913 it had a top rate of 7 percent and created a tax liability for only 2 percent of the population. But the top rate shot up to 67 percent in 1917 and 77 percent in 1918, the war years. The state's haul during World War I was more than $1 billion, ensuring its longevity as part of the revenue system. During World War II the income tax became universal. Fewer than 15 million tax returns were filed in 1940; by 1950, the number was over 53 million. "In 1939 the income tax raised $1 billion. In 1945 it raised $19 billion. The most lucrative revenue pool was not the wealthy -- there weren't enough of them. Middle-class and working-class taxpayers represented the biggest potential for revenue." What began as a movement to rob the richest Americans has turned into a burden for anyone making a decent living. Isn't it funny how government takes such a "noble" goal and corrupts it for its own purposes. Richman believes people will need a new "unwritten constitution" before they'll revolt against the tax. "What is needed is the orneriness about intrusions on their liberty that the colonists and first Americans exhibited." I emphatically agree. Sheldon Richman, a first-rate researcher and a master of clear writing, has written a powerful monograph. I give it my highest recommendation.

Your Money or Your Life

Published by Thriftbooks.com User , 21 years ago

Christine SpaldingCritical ThinkingProfessor Kevin J. BrowneNovember 29, 2002Your Money Or Your LifeSheldon Richman's argument is based on the moral issue of the income tax and why this tax should be abolished.Richman presents us with facts and claims of how our government is flawed by forcing the American worker to give up a portion of his income, though no one actually consented. Along with surrendering a percentage of our earned income, we must allow them to have access to our personal financial records of the exact amount one earns. The tax enforcers accomplish this through lies and deceit. Both which preceded and followed the Sixteenth Amendment.The American wage earner is "commandeered", says Richman, by this taxation, and if you do not, the government will institute a fine or even have you imprisoned. His conclusion is this is theft and unjust.Richman's other basic argument's for abolishing the income tax is as follows:1. The state demands a sum of our money, and refusing to give it up is punishable.2. It is a voluntary system.3. Repercussions for not volunteering.4. It is wasteful.5. It illustrates the corruption and out of control spending by the government. 6. Lawmakers need a never-ending flow of cash7. The income tax is the only tax allowed that corrupts society.8. The income tax is a blank check for the government.9. The income tax makes you poorer.Richman presented clear and convincing arguments for his reasons to abolish the income tax. Richman also makes an interesting comparison of the government being like a mugger who "occasionally shines his victim's shoes", and a membership to a club has access to certain amenities only if the dues are paid, it not one is not allowed in, not arrested. By the same token, a property owner who is not "actively using the government's services" still owes the taxes.This argument of why the income tax should be abolished by Richman is deductively strong. Mr. Richman used statistical evidence as well as causal arguments through out.

A must read for every single American

Published by Thriftbooks.com User , 22 years ago

This book is one of the best written on the subject of abolishing the income tax. As Americans, we have been taught that paying our fair share of income taxes is the American way and our patriotic duty. Nothing could be farther from the truth. In fact, the income tax is 100% against the American way and violates our very own Constitution.This book exposes the complete history of the income tax, and its tyrannical, Gestapo like collection agency, the IRS. The IRS is the most feared organization American has ever known and they operate outside the bounds of the Constitution that is supposed to protect us from tyranny in government. What happened? Read this book to find out all of the sordid details.Not only is this book a history lesson, but more importantly, it shows that we can survive without the income tax as we did for more than one hundred and fifty years before this form of communism was implemented into our lives.If every American read this book, there would be a revolution by tomorrow morning.

Every American Should Read This Book!

Published by Thriftbooks.com User , 24 years ago

Sheldon Richman's concise and informative book, Your Money Or Your Life, explains how the income tax is one of the greatest threats to the liberty of the American people ever devised. By making our employers surrogate federal tax collectors, most Americans don't feel the pain because they really don't know what they're losing. But even worse, as Richman points out, by having access to our paychecks, the government can tap into an almost limitless pool of money to expand its size and scope. We need to scrap the income tax and replace it with a tax on consumption.

Unassailable Polemic! Richman Crucifies Income Taxtation!

Published by Thriftbooks.com User , 25 years ago

So much writing about income taxation are shaggy dog works of politicians and those who would appease them. This work is for the mind what a shower is for the body after a hot day of shoveling elephant and donkey manure, if you know what I mean.Richman shows that the ideas behind income taxation are evil. Like an evil tree, you can try pruning it, but it will bear evil fruit again inevitably. Therefore the only solution is to cut it down!A consistent version of the American political idea would not tolerate income taxation, for it is too invasive and exploitative. It facilitates misspending and unaccountability.Almost without exception, when the boys in Washington declare war on anything or anybody, it's a diversion. You should know that while we're being told to "prepare for a long long war on terrorism," the IRS is trying to tool up to take over you life as never before, via advances in computer technology coupled with no meaningful change in the tax system. Now we're being told that not only must we bomb in Kosovo, but we may also follow up this action with some punishment of war crimes. In contrast, when IRS comissioner Charles Rosotti was asked whether the known abusive agents of the IRS would be punished, he said that they'd be look into it, but didn't want to be too hasty because acting hastily had caused problems in the past. (Am I the only one who finds a pattern with this President's administration wherein it betrays those closest to home while focusing much attention elsewhere?Buy this book. Muster some courage. Vote Libertarian. Let's go into the new millenium as a free country for the first time in over 80 years!