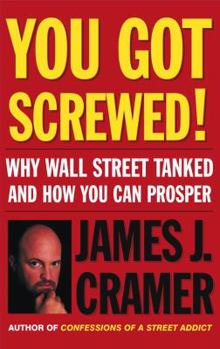

You Got Screwed!: Why Wall Street Tanked and How You Can Prosper

Select Format

Select Condition

Book Overview

You've been screwed.

You've been bludgeoned, skewered, crushed, mutilated by the stock market. Every day you read about another corporate scandal: loans to CEOs that didn't have to be repaid, accounting "irregularities," profits that never existed. You think the stock market must have been rigged. And you're right.

You were betrayed by the stock promotion machine -- the mutual fund managers, the brokers, analysts, strategists, and stock...

Format:Hardcover

Language:English

ISBN:074324690X

ISBN13:9780743246903

Release Date:November 2002

Publisher:Simon & Schuster

Length:128 Pages

Weight:1.65 lbs.

Dimensions:0.6" x 5.5" x 8.6"

Related Subjects

Business Business & Investing Economics Introduction Investing Personal Finance Popular EconomicsCustomer Reviews

5 ratings

Very informative, worth every penny

Published by Thriftbooks.com User , 16 years ago

This short but very informative book gives you a history lesson on how companies have been screwing over the public for years to make a small group of people a lot of money, It teaches you how to watch for it and avoid becoming a victim of insider trading yourself. Worth every penny.

Trust no stock under $30????

Published by Thriftbooks.com User , 18 years ago

Jim Cramer rules. Anyone who can mix schadenfreude (German for vicarious pleasure in others' misery), Pangloss from CANDIDE, sports analogies, and pop culture references with a straight shooting approach to finance and investing is cool. More importantly, he does a better, more readable job of dissecting big bad Corporate America than Michael Moore ever could (Cramer and Moore both got skewed in a bad-guy list of RADAR that stated the scariest facts about both, respectively, were "Is married and has children," and "Won an Oscar"). Jim Cramer isn't a get-rich-quick franchise.

Sweet and Short

Published by Thriftbooks.com User , 19 years ago

I have undergone usual love-hate type feelings towards Cramer multiple times. It is really diffficult to understand him, especially when he was writing his trading diary on realmoney. Now that the greatest bear market is (probably) over, and I lost my share of money in it, I understand what Cramer was saying back then. I mean in 2000. In March. In 2001. This book is small, and I had missed a lot of games that wcom and enron played with unsuspecting people. I was already out of markets as I could not survive earlier waves of selling. I went back and read Cramer's writings in March, 2000. Most people think he is just a pumper - I was surprised that he repeatedly urged people to get out of markets - "cash is king" was his mantra during the bearish cycle. And he nailed it both, the great bull ride and the bear ride, with almost correct timing. You can hate him, he did what he had to do at his hedge fund, a lot of what may be immoral - he had to, it his job. But his writing has been on the mark - you can't deny that. As for the plug, he mentions thestreet.com few times which is a FREE news site. I do not recall him mentioning realmoney.com ever in this book, which is paid content. At the end, he just "mentions" his own investment product "alerts", but that is only if you want to do it with him. His first choice is always a seasoned investment adviser whom you can trust.I am not his employee, just a general trader. I would now trust Cramer more than any other Wall St analyst or a journalist who doesn't know a thing about the markets.

Who's Screwing Who?

Published by Thriftbooks.com User , 20 years ago

You just gotta love Cramer. Whether he's on his knees confessing to being a stock market addict or crawling across the table, ranting and raving on CNBC, he entertains, invigorates, and educates. But he's also a bull in the china closet - so now, after the 2000-2002 debacle, we get his condemnation of the whole Wall Street scene inscribed with the immortal words, "You Got Screwed," as he picks over the underbelly of the tainted beast. Yes, it's a short book, but that's its selling point: Cramer crams everything into something you can sit down and read in a couple of hours - and actually understand via his take-no-prisoners style. His brash attitude is more of the street fighter than the wood-paneled office executive, and this train wreck of a market comes alive with real personalities backed up against the wall as Cramer blasts them to bits. No words wasted. Just typical Cramer. You either love him or hate him, but you can't ignore him.First he tells you why the system reeked and rotted, eventually collapsing under the weight of fakery and fraud. Then he ends the book by advising you how to never be caught up in Wall Street's self-serving ever again. And he does a good job of both.His advice on how to protect yourself in the future is good, basic, Investing 101: "Admit the crash happened and move on, find a trusted financial advisor if you won't or don't want to do the homework yourself (he advises 2 hours a week), investigate and analyze companies prior to putting one red cent into them, forget 'buy and hold,' learn to read balance sheets, put emphasis on dividends, monitor insider and corporate ('buybacks') buying of their own stock, use P/Es to value stocks, always keep cash available, and avoid margin." Good advice from a pro who's seen and done it all. Now the fun part begins. Mutual funds end up getting the brunt of the Cramer cannonballs. The game they played was "beat the numbers." The financial press loved it because it gave them "the reason" why the market was going up. Made they look smart. Cramer takes apart this silliness, exposing it for what it was - accounting gimmickry, pure and simple. All that the analysts and companies had to do was lowball the upcoming quarter, then "beat the number" by a penny, and we were off to the races. So why was the investing public taken in so thoroughly? "The public thought it knew all it had to know...Democratization (of stocks), however did not bring with it all the skills you needed to make good judgments for the long term. For example, no one provided the tools of how to read a balance sheet or assess cash flows. No one taught people how to spot red flags or how to tell if a company wasn't doing as well as you thought. And no one explained that stocks, particularly tech stocks, were high-risk pieces of paper..." (26)Moving on to corporate governance, Cramer slams the looting of the treasury via stock options as corporate insiders served themselves a hearty dish of cheap stock, seemingly at no co

A Very Timely Read!

Published by Thriftbooks.com User , 21 years ago

Cramer is an easy target for criticism, but this simple book has tremendous value.I took this book with me on a 7 day Caribbean cruise and had a great time reading it under the coconut trees of St. Maarten and Antigua. Being away from CNBC, Wall Street Week, and the constant media attention to the stock market was a welcome reprise.And so was this book.At first glance this book may seem a little bit light on information. It's only 117 pages long at a time when we expect about 300 pages from a typical John Wiley-type finance book. But it's not the number of pages that counts, it's the information, personal interpretations by Cramer, and solid financial wisdom that matter.By the time I actually got around to reading this book (on those great beaches), I must say that I truly enjoyed it!The book is divided into 3 very distinct parts. The first part is about how the public got totally used by Enron, Worldcom, and Rhythms Net type scandals. Since all of these events were so recent it doesn't take long before you start recalling all the pieces of information that came out about these cases. Mr. Cramer does a nice job of taking us all back to those days and recapping what went wrong. Each one was revealing in its own unique way. And yes, we got used!The second part pinpoints the other culprits in the stock market's two and a half year demise (and giant NASDAQ crash!). Cramer reminds as of the all-stocks-all-the-time mentality that came to be at the market's peak. Also the potential danger of executive options, shady accounting, too many one-way mutual funds, and always bullish brokerage firms. And by the way, these culprits are still at today!!!And finally, there is the last section about what to do. Here is current advice and simple guidelines to avoid getting used again in the future. Some of the gems are:1) Have some bonds for income2) Have some cash for annual buying opportunities3) Buy stocks in incremental "get your feet wet" amounts4) Buy at least 5 stocks from 5 different industries5) It's okay to sell 6) Sell some on the way up7) Sell your losers because bad stocks may not go up at all8) Know your stocks and how they make money so you have a feeling of their value.9) Buy index funds for diversification and low expenses10) Hedge funds are better than mutual funds in concept. Here's something to research more on. Mutual funds are financial products who's time has gone.For those readers who want an enjoyable read, who watch CNBC, have an interest in tech stocks, and feel like they were used and want to avoid it in the future, here's a book for you. It's a reminder of how to keep your head when things get too crazy on either the upside or downside.A very timely piece!P.S.: As a fellow author I can understand Mr. Cramer's disappointment in the reviewing process. Some people think it's a sign of brilliance to degrade intellectual property when it's simply a matter of them just not getting it. My advice to these negative types is to stand aside if you