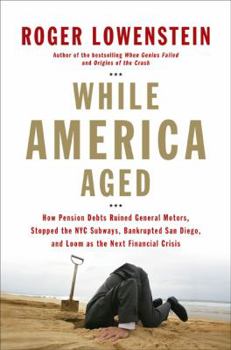

While America Aged: How Pension Debts Ruined General Motors, Stopped the NYC Subways, Bankrupted San Diego, and Loom as the Next Financial

Select Format

Select Condition

Book Overview

"While America Aged" illuminates the scope of the problem we re facing, and warns that the worst is yet to come. With the narrative flair and talent for decoding financial ambiguities that readers... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:1594201676

ISBN13:9781594201677

Release Date:May 2008

Publisher:Penguin Press

Length:274 Pages

Weight:1.15 lbs.

Dimensions:1.0" x 6.5" x 9.3"

Age Range:18 years and up

Grade Range:Postsecondary and higher

Related Subjects

Business Business & Investing Economics Finance Law Personal Finance Retirement Planning Tax LawCustomer Reviews

5 ratings

Worthy Praise

Published by Thriftbooks.com User , 15 years ago

Almost every review here begins with how exceptional Roger Lowenstein is. This review does also. In fact, it's hard to describe how interesting this book really is, considering that the issue at hand is a considered a boring one at that - pensions. Lowenstein brings an extremely in-depth amount of research to demonstrate truly that happens. The fact that most of the public is still unaware of this shows how what appears to be such a small issue has really undertaken our companies. The facts and the characters in each example deserve praise. Although we would hope that many of our top executives would not be so short-sighted as to giving unions constant pension raises, Lowenstein is able to demonstrate how unions effectively strong-armed executives into doing so. As I write this, I stare at the analyst reports that declare there is a possibility, although small, of General Motor declaring bankruptcy. Unbelievable. I would sincerely recommend anyone that has an interest in pensions, or in just any business interest to take a crack at this book. It isn't famous, not like Lowenstein's others, but it certainly is well-written and deserves much praise in keeping what could be a boring topic exceptionally interesting. I don't want to give it all away, but the intricate research that Roger Lowenstein has done shows through with almost every page. I can't exactly narrow down what it is about his style, but there's an eloquence to it that makes reading his books almost .. as if the book is reading to you.

reasonable fear

Published by Thriftbooks.com User , 15 years ago

Roger Lowenstein is one of the most accomplished financial writers around. Pensions are a boring subject. Who would ever have drinks, on purpose, with an actuary? Maybe if you were stuck on a plane next to one, and the liquor were free... Lowenstein is able to make them seem both dramatic and important. Something has escaped our attention. Pension benefits have been piled on by labor unions and politicos without regard to their ultimate cost. Lowenstein makes it pretty clear through several recent and important examples that this is nothing short of a disaster. But why should it matter to us? Because we face a huge pension shortfall as Social Security becomes underfunded, and many states are verging on bankruptcy... The negotiations Lowenstein depicts are as dramatic as those of The Smartest Guys in the Room - and equally rife with chicanery. Though he's deft with analysis, rendering the complex simple, he's got a knack for characterization and drama that belies what might be considered remote and dull subject matter. Once you read the book though, you won't feel the same way about pensions or even unions - though of course unions have greatly benefited the US at other moments in our history. So read it and weep! Or get mad and do something about it.

Pension plans are not the problem, but the underfunding is

Published by Thriftbooks.com User , 15 years ago

I am glad to see the inadequacy of public pension plan funding getting more attention. The book is extremely well written and easy to read. It provides valuable insight into the pension plan decision-making process, and shows the danger in trading benefit improvements for inadequate contributions. As Roger Lowenstein points out, public pension plans themselves are not the problem, the problem is that they are so often underfunded. Contributions to public defined benefit plans calculated under traditional actuarial methods are not necessarily sufficient to make a plan actuarially sound. There is a need to establish rules for funding contribution calculations to strengthen the actuarial soundness of public plans. The current rules allow payments to be made on the unfunded liabilities that are less than the interest on the liability. At least for mature plans that are poorly funded, the payments made on the unfunded pension liabilities should be accelerated. Consideration should be given to requiring minimum contributions to public pension plans.

Lowenstein Does Not Disappoint

Published by Thriftbooks.com User , 15 years ago

Is it just me, or is Roger Lowenstein one of the best writers going. If you liked 'When Genius Failed', 'Buffett, The Making Of An American Capitalist' and 'Origins Of The Crash', you won't be disappointed with 'While America Aged'. Top-notch writing, top-notch research. Brings to light events you may have read about in WSJ and NYT. Always thought unions were a mixed blessing. Now I am certain. Required reading for people who are not saving enough for retirement.

The Collapse of America's Pension System

Published by Thriftbooks.com User , 16 years ago

The nation's pension system is collapsing at the same time its population is aging. In the late 1960s, 60% of Americans were covered by a pension plan; today it is under 20% of those in private employment. Pension funds in the private sector are $350 billion in deficit, and many employers (IBM, Sears, etc.) are freezing their plans to keep obligations from growing further. Similarly, states and localities are hundreds of billions behind on funding, and Lowenstein declines to even get into Social Security's status or obligations for health care to retired public employees. (In another source Lowenstein estimates a $1 trillion deficit for retired public employees - presumably this also includes health care.) "While America Aged" covers how we went from almost no pensions in the early 1900s (most worked on farms, and 'retirement' consisted of working less while relying more on family members), to a high proportion of coverage (more workers were in industry), to unsustainable benefit levels, using three case studies (G.M., the New York City subway system, and San Diego municipal employees). In each case, management officials were lulled (and sometimes forced through long strikes) into acceptance by the delayed impact involved. At first few, if any workers were retired, and they were supported by a very large employee base. In G.M.'s case, the firm also benefited by being the dominant force in the industry - 50%+ market share. Then autoworkers aged, Japanese autos reduced G.M.'s market share, cheap money to encourage home ownership and consumer spending undermined G.M.'s ability to attain adequate pension-fund earnings, and G.M. dug itself in even deeper with unrealistic assumptions on fund earnings and further benefit increases. Thus, from 1991-2006 it poured $55 billion into its pension funds, and only paid $13 billion in dividends. To date, most corporations continue to minimize the problem, or pass off pension obligations to the government through bankruptcy, especially steel and airline companies. Unfortunately, the PGBC program is in deficit as well, and not designed to also take the burden of municipal pension funds. New York City's transit, teachers, sanitation, firemen, and police public employee unions engaged in a "leapfrog" contest during the 1960s. Between them they steadily increased pension benefits through lowering the age of retirement, the proportion of "ending" salary paid upon retirement, changing "ending" salary to just the last year and including overtime (a extra $76 in overtime pay during a retirees final year created $1,100+ in pension liabilities), adding an inflation index provision, and reducing/eliminating employee contributions. These escalating costs for the MTA were hidden through deferred maintenance, state and federal aid, a soaring stock market, actuarial manipulation, and increased taxes. Mayoral egos bent on higher office often facilitated these additions. All this on top of high pay - in 2005 t