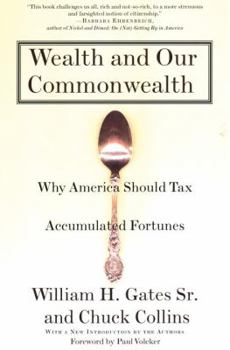

Wealth and Our Commonwealth: Why America Should Tax Accumulated Fortunes

Select Format

Select Condition

Book Overview

More than a thousand individuals of high net worth rose up to protest the repeal of the estate tax-Newsweek tagged them the "billionaire backlash." The primary visionaries of that group, Bill Gates... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:080704718X

ISBN13:9780807047187

Release Date:January 2003

Publisher:Beacon Press (MA)

Length:184 Pages

Weight:0.75 lbs.

Dimensions:0.8" x 6.3" x 8.6"

Customer Reviews

5 ratings

Original Indigenous Economy has truths to help us grow.

Published by Thriftbooks.com User , 19 years ago

This review is excellent but I believe that those of us who live in Turtle Island will develop unified systematic responses only when we begin to honour the heritage of First Nations. The common wealth of First Nations was brought about through inclusive and comprehensive accounting practices, which valorized the contributions of all community members. This primary accounting including women's and social work took place in the Production Societies of each community. This accounting unified ownership for all members of the Production Societies. Wampum and other string currencies were issued across the 36 Confederacies of Turtle Island. People not only voted with their Wampum but spent it as currency as well. Ownership was progressive from the early status of an apprentice to the weighted Wampum 'share' holdings of the elder. What is missing in our capitalist and socialist worlds is their unity. Both systems hold part of the puzzle. Both developed as institutional fragments of a once integrated whole. The wonderful thing being that First Nations still hold many clues to understand this ancient system from aroung the world. You can imagine the difference between a whole culture of economic justice and merely a complaint department in a crooked department store. While Gates and Collins book is essential, it is through cultural indigenous economic design that we gain the involvement to make a difference. Western authors tend to keep us in critical analysis but still divided. Douglas Jack, eco-montreal@mcgill.ca (514) 695-3845

6 Stars Out of 5

Published by Thriftbooks.com User , 20 years ago

This extraordinary little book packs a gigantic punch. I'd love to summarize it here, but as soon as you buy the book, get straight to Chapter One. It's enough to make you sick in the stomach.Is America a "democracy"? After Ch.1 you really wonder. A sample from p. 15: Around the turn of the century, shortly before WWI, the top 1 (one) per cent of the population owned 56.4% of the country's private wealth - at the same time, the authors tell us, "the wealthiest 10 [ten] per cent of households owned 90% of all wealth." Now, think about it: 90% of Americans together owned a mere 10% of the country! (And most of the country's wealth was in private hands, because the government at all levels owned very little of value. There wasn't even a national park in existence!) That's neither justice nor democracy.American society started to improve since then, especially after the introduction of income tax. But things have again gone in the opposite direction in the last two decades, so that "the United States is now the most unequal society in the industrialized world." (p. 14)This fact is borne out in the UN Human Development Report 2002. (I was surprised that this authoritative publication is NOT cited anywhere in this book.) This report gives the "Gini Index" for each country, among numerous other data. The Gini Index is not something out of Aladdin: It "measures inequality over the entire distribution of income or consumption. A value of 0 represents perfect equality, and a value of 100 perfect inequality." (p. 197) Ranked are these selected countries in the industrialized world: Denmark (24.7 - the least unequal society), Japan (24.8), other Scandinavian countries (including Finland) at around 26, then Germany (30.0), then English-speaking countries like my own Canada (31.5 - the lowest in this group), Australia (35.2 !!), the UK (36.8 - hardly news, what with their queen and lords), and finally the United States at 40.8. (France, the host of the French Revolution, is a surprising 32.7.) For comparison, developing China is 40.3 (beats the US by a hair - but not for long), India only 37.8 (I guess only a couple of people can be called rich there), and Russia is the most unequal of all at 48.7.....but then Russia is now run by a mafia of ruthless moneylords, much like America a century ago, when men like Rockefeller and Al Capone ran all the shows. (Still it is better than the gulag and secret police. And anything is better than communism.)Getting rid of the estate tax won't help one bit. On the other hand, not repealing it in and of itself is just a small step in the right direction, hardly enough to stop the country from sliding down the slippery slope to a second Gilded Age. This book makes a very convincing argument why getting rid of the estate tax is truly a form of insanity the name of which is still not in the psychiatric textbooks. Bill Gates Sr.'s position is supported by his son (the world's richest man - mostly self-made). Warren Buffett, the w

Must Reading for Every Member of Congress

Published by Thriftbooks.com User , 21 years ago

Most controversial issues have two sides. The authors of this book present the arguments in favor of abolishing the estate tax in "the best light" by quoting at length and in context the abolition proponents' rationale. They then destroy these arguments by showing how and why they are based on false and often misleading "facts." They also make the case as to why an estate tax on those few accumulated fortunes which are, even under the pre-2001 law, subject to the tax is an important foundation stone of the American Experiment. I am not naive enough to believe that those who have made a career of opposing the estate tax will be swayed by the authors' book, but anyone with an open mind should be.

Brilliant. A must read for those who care about the USA.

Published by Thriftbooks.com User , 21 years ago

This brief book strongly explains how society will benefit from keeping an estate tax on the wealthy. It explains how the estate tax allows America to be a meritocratic place where the best and brightest rise to the top and can make the most positive social change. It explains how charity giving will increase during wealthy individual's lifetimes if they know they face a big tax at the end. It gives a brief history of the estate tax and why it was introduced in the first place. It exposes the hypocrisy of Bush's estate tax repeal that expires in 2010. All in all, it provides a very concise argument why we must give back to the society which enabled us to have the potential to become wealthy in the first place. I never thought I'd be able to read through a book on tax law without putting it down. This book is brilliant.

Outstanding, comprehensive and brief!

Published by Thriftbooks.com User , 21 years ago

Not written for numbers people, but for those interested in public policy and the future shape of our society. Shows how the unseen -- or perhaps frequently unexamined -- hand of a major part of tax law has profound effects. Treats all aspects of the debate. Gives a fair history of a number of main points around the last century's debate about appropriate national taxation. Lucid, readable; reasoned but passionate. Great suggestions for further reading. And all this in fewer than 140 pages plus appendices. Deserves a Pulitzer.I have been a tax accountant for over 25 years, with a professional interest in this subject, and I learned a great deal!