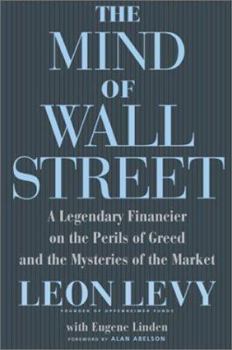

The Mind of Wall Street: A Legendary Financier on the Perils of Greed and the Mysteries of the Market

Select Format

Select Condition

Book Overview

As stock prices and investor confidence have collapsed in the wake of Enron, WorldCom, and the dot-com crash, people want to know how this happened and how to make sense of the uncertain times to... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:1586481037

ISBN13:9781586481032

Release Date:November 2002

Publisher:PublicAffairs

Length:240 Pages

Weight:0.15 lbs.

Dimensions:0.9" x 6.4" x 9.6"

Customer Reviews

5 ratings

Psychology plays a part whenever people make decisions

Published by Thriftbooks.com User , 14 years ago

Even though this book does not give readers many how-to tools and techniques to be successful investors, I still enjoyed the story of Leon Levy's life and investment philosophy. I totally agree with the author that psychology affects the stock market. When stocks are going up, investors are happy and ignore all the bad news. When stocks are declining, they do not believe any good news and scrutinize things harder. The author also took a long-term view on investing while the rest of Wall Street only cared about short-term results. - Mariusz Skonieczny, author of Why Are We So Clueless about the Stock Market? Learn how to invest your money, how to pick stocks, and how to make money in the stock market

Rare Insight from a Seasoned Professional

Published by Thriftbooks.com User , 19 years ago

If you are looking for a secret formula to accumulate wealth in the stock market, don't buy this book. Leon Levy, a founder of Oppenheimer Funds, Odyssey Partners and legendary investor, reflects on his more than 50 years of investing experience to explain why the market confounds so many. He borrows from his avocations, psychology and archaeology, for perceptive insights into the financial landscape. Success in finance, he says, is an art form, not a science. It relies on the vagaries of the human condition. Readers who search this book for a secret wealth formula will be disappointed. The only door, Levy says, that leads consistently to wealth, is access to privileged information. As many have recently discovered, this path is fraught with peril. Yet, if investing is an art form, it can be learned. The best way is to put yourself on the line. Take a position. Players outperform professors. Recognize your weaknesses. Seek to control them. I was particularly interested in Levy's insights into the collapse of Savings and Loans, the hedge fund Long Term Capital Management and the Internet Bubble. This book does not belong in the class bad books written by bored billionaire investors, too many of whom have confused luck with insight. Although these individuals have a high regard for themselves, clarity, coherence and conciseness are not among the qualities which contributed to their success. Leon Levy is likeable, incredibly informed and nothing short of brilliant. Investors for generations to come will be grateful he finished his discourse on of greed's perils and the market's mysteries.

A Wall Street prophet

Published by Thriftbooks.com User , 21 years ago

This is a book that every investor should read. People who are looking for a trading system or some cookie-cutter program that will make you rich will be dissapointed. Although he made hundreds of millions of dollars, I doubt Levy himself had an exacting system that he used. He knew how to manage risk and look for low-risk opportunities. He also knew how to take advtange of new investment markets - which are almost impossible for average investors. Leveraged buyouts for example.Nonetheless, if they take the effort this is one of the most important investment books that someone can read in this moment in time. Levy's book is one that will make you think. As he recounts the past 50's years on Wall Street you'll see how the stock market changed and how the psychology around it did too. Going into the 1950's, people, remembering the 1930's, were extremely bearish about the market. Levy wouldn't hire anyone under 30 - not because he wanted youth, but because he feared that those older would be too cautious, because of their life experiences of the depression.Contrast that bearish sentiment, with today where every down day is heralded as a bottom and a one week rally is called a new bull market, and you'll see how different the eras are. You'll also realize how different the risk to reward ratio for stock investors is.I have come to the same conclusions that Levy has concerning our market and our economy and where the coming investment opportunities are in the world. I was already in agreement with him before I read his book. That is why I strongly recommend that people read it. This is one of the few mainstream investment books that you can find that will give you a good picture of what has happened to our markets in the past decade and where it is likely to go in the next 10 years - and where true investment opportunities lie in the world. This is all done in a crisp, engaging style, that makes for a quick read. If you want to understand what is going on read this!Even if you have an investment/trading style where you don't think this is important you need to read this book. I personally trade mostly on charts and technical indicators. However, if you are trading a trend in the market it is helpful to have a knowledge about what is moving the market. That makes it easier to have believe that what the charts are telling you is real. You need to believe in your convictions. That is why it is important for investors and traders to keep up with the news and take the time to read books such as this one. I spend a lot of my time involved in the financial markets and usually read books as a way to get away from them. When I take the time to read a financial book it has to be a good one and this one didn't disappoint.This book is never going to be one of the trading classics, like Jesse Livermore's Remicenses of a Stock Operator. However, 10 years from now it will be known as one of the few books that warned of what was to come.

Levy's Perspective on the past 50 years

Published by Thriftbooks.com User , 21 years ago

Levy's financial memoir tells of his 50 years on Wall Street. He highlights his contributions including the success of Oppenheimer. He tells many tales, including the collapse of Long Term Capital Management in 1998. He blames that collapse on the fund manager's overconfidence in the efficiency of markets. Levy offers his perspective on the recent stock market bubble, concluding the bubble continues (with lower prices ahead). His conclusion that Newt Gingrich's 1995 "contract with America" paved the way for the egregious acts of corporate executives and accounting firms makes for interesting reading.This book is worth your time.

A Fresh Perspective

Published by Thriftbooks.com User , 21 years ago

Finally, a description of what happened in the late 1990s from someone who clearly knows what he is talking about. Most importantly, Levy has no axe to grind. His book offers a window into how big gains and losses are really made and includes lots of stories I've never heard elsewhere. Unlike other Wall Street books, the tone is not high brow or that of a "know-it-all" but rather one of someone who has a real interest in what makes people do the crazy things we do.If you are tired of the same old hogwash, then read this book.