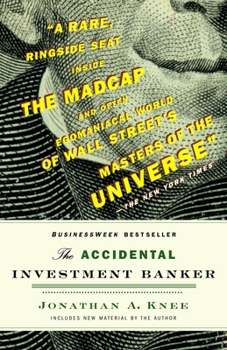

The Accidental Investment Banker: Inside the Decade That Transformed Wall Street

Select Format

Select Condition

Book Overview

Jonathan A. Knee had a ringside seat during the go-go, boom-and-bust decade and into the 21st century, at the two most prestigious investment banks on Wall Street--Goldman Sachs and Morgan Stanley. In... This description may be from another edition of this product.

Format:Paperback

Language:English

ISBN:0812978048

ISBN13:9780812978049

Release Date:July 2007

Publisher:Random House Trade

Length:288 Pages

Weight:0.55 lbs.

Dimensions:0.6" x 5.3" x 8.0"

Customer Reviews

5 ratings

Excellent I-banking stories

Published by Thriftbooks.com User , 17 years ago

This book describes the personal journey the author had gone through during his decade in investment banking. He talks about what's involved in investment banking, office politics, the incentives that drive the hehavior of the bankers, dynamics of the competitive landscape the clients. He also quotes or put in a nontrivial amount of material that he did not experience first hand, in order to provide the background or history of stories or issues he's talking about. The author is quite candid, albeit with a trace of hidden bragging of his smarts and achivements. I have read "Monkey Business", "Liar's Poker" and "Goldman Sachs : The Culture of Success". Each book has its own strength. The strength of this book is description of politics, dynamics of the relationship between investment bankers and their clients. As writing style, this book is easy to follow, a pleasure to read. In a way, it reads like a story, keeps you wanting to find out what happended next. However, it is relative slow to go through this book, as least for me, because the book is actually quite dense.

Very True, Very Real

Published by Thriftbooks.com User , 17 years ago

I could really relate to this book. Up until four months ago, for the previous seven years, I was the General Counsel of a medium sized publishing company. Our company was backed by Private Equity, and a large part of my role was mergers and acquisitions. During that time I interacted with more investment bankers, bankers, and money fund managers than I could possibly remember. Prior to that I worked for a couple of years in the M & A group of a Fortune 500 publishing company, and prior to that I spent 20 years in government and large law firms. I have never personally met Jonathan Knee, at least not that I remember, but my company danced and flirted several times with his current company. I knew people at pretty much every boutique publishing investment bank in New York. So, while I didn't work as an insider at an investment banking firm, I've been as close as you can get. And this books is absolutely dead on accurate both in its historical perspective as well as its view of what life is like inside the investment banking industry. Knee comes across as somewhat conflicted. He obviously likes the money and maybe the prestige of investment banking, but he knows that investment banking has a side that is ugly and corrupt. He wants to continue in the industry, but he also wants to expose its faults. As a consequence sometimes the book waffles. For example, he criticizes Mary Meeker and defends her at the same time. He clearly does not want to burn any bridges. He accurately captures the sense of power and feeling of doing something important that comes from investment banking. In particular the satisfaction of advising CEOs and seeing ones advice taken. Based on my own experience, in the world as it is today, the feeling of doing something important can be much more tangible when working with big business than working in the government as he notes. Still, he longs for a different time when relationship investment banking was the heart of the business. I have the sense that if one were really to talk with him heart to heart that his awareness of the corruption runs deeper than he is willing to fully disclose in this book. In part I think this is the reason some of the reviewers here were disappointed with the book. However, I also think the palpably conflicted nature of his feelings ultimately makes this book more interesting, if less of a simple entertainment. If you are looking for a rollicking but superficial account of the investment banking world, along the lines of Liar's Poker, this is not the book. If you are looking for a deep historical analysis of the growth of investment banking, along the lines of something written by Ron Chernow, this is not the book. But as a thoughtful insiders account with good historical perspective, this is an excellent book

Excellent

Published by Thriftbooks.com User , 17 years ago

The Accidental Investment Banker is an excellent mix of Wall Street "war stories" and an analysis of the evolution of investment banking. The "war stories" are both engaging and colorful, and are weaved into a thoughtful discussion of how investment banking has changed - specifically, from institutions focused on building long-term relationships with their clients to myopic firms focused solely on short-term profits. A must-read for anyone working on (or interested in) Wall Street, and one of those rare books where the intellectual value is equal to the entertainment value.

Wall Street Spectator

Published by Thriftbooks.com User , 17 years ago

The Accidental Investment Banker (the "AIB") has been compared with Liar's Poker, and surely readers who enjoyed the latter will also enjoy the AIB. But in some respects the comparison is unfair to the AIB, because as it is not only a quick and amusing story of Wall St in the '90s, but a serious analysis of a transformative decade in investment banking. As an attorney who participated in the process on the periphery, I can testify that Knee understands the key economic, business and regulatory trends and knows the"trophy" bankers who shaped decade, and the culture of their firms. The AIB is a great read for anyone on the Street (or in the "City," for that matter), anyone in the "codependent" professions (lawyers and consultants), MBA candidates and those contemplating it, and anyone who enjoys Wall St. as a spectator sport.

An Insider's Look at I-Banking History

Published by Thriftbooks.com User , 17 years ago

Jonathan Knee's book provides an insider's look at the wild ride that was investment banking in the internet boom and then bust. For anyone who lived through this era, the book provides an enjoyable and realistic trip down memory lane with enough fun anecdotes and keen observations to keep you laughing. More importantly, though, the book gives a sense for history and makes a compelling argument about what has changed in investment banking and why. Regardless of whether one agrees or disagrees with Knee's thesis, this is one topic worth debating and Knee does an artful job of blending history and conversational story-telling, sprinkled with entertaining personalities. Easy enough to understand for someone outside the industry while sophisticated enough for someone inside, the book is an enjoyable and worthwhile read.