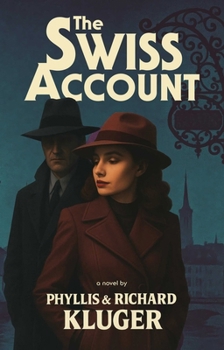

The Swiss Account

The Swiss Account follows the Hazeltines' descent into an ethical gray zone as they wrestle with their anguished consciences and navigate a minefield of legal peril. Are they decent people trapped by circumstance or clever schemers rationalizing their path to riches? Switzerland's majestic peaks and remote valleys form a natural fortress at the heart of Europe--beautiful, prosperous, and long insulated from the political and military upheavals of its neighbors. This isolation, combined with the government's unwavering commitment to banking secrecy, has made the country a discreet haven for foreign wealth, both legitimately earned and dubiously acquired. While most countries don't forbid their citizens from holding Swiss accounts, they do require such assets to be reported and taxed. Which is why many account holders, reluctant to comply with their own tax authorities, prefer to keep their holdings secret. Leo Beckwith was one of them--a highly successful American entrepreneur who left behind a tidy Swiss fortune. But without explanation he willed his shady hoard not to his favored children but to Lynn his long overlooked daughter--a hard-working real estate agent in Bucks County, Pennsylvania. The windfall promises lifelong financial security for Lynn, her husband Jerry Hazeltine, a modestly paid art history professor, and their family. There's just one problem: Leo never reported the account to the US Treasury. Now the Hazeltines face a profound moral and legal dilemma. If they come clean, the IRS will likely seize the fortune to settle Leo's long-evaded tax bill. If they don't, they become tax evaders--living on Easy Street, but under constant threat of discovery and prosecution.

Format:Hardcover

Language:English

ISBN:1644285517

ISBN13:9781644285510

Release Date:April 2026

Publisher:Rare Bird Books

Length:376 Pages

Customer Reviews

0 rating