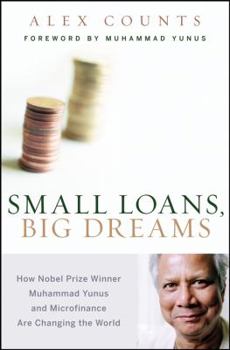

Small Loans, Big Dreams: How Nobel Prize Winner Muhammad Yunus and Microfinance Are Changing the World

Microfinancing is considered one of the most effective strategies in the fight against global poverty. And now, in Small Loans, Big Changes, author Alex Counts reveals how Nobel Prize Winner Muhammad... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0470196327

ISBN13:9780470196328

Release Date:April 2008

Publisher:John Wiley & Sons

Length:410 Pages

Weight:1.45 lbs.

Dimensions:1.5" x 6.4" x 9.1"

Customer Reviews

5 ratings

Don't Miss This!

Published by Thriftbooks.com User , 14 years ago

"Small Loans, Big Dreams" has it all. It's a wonderful book about the story of micro-finance based on Dr. Muhammad Yunus' Grameen Bank model. Several women in Bangladesh and Chicago generously share their personal stories with author/economist, Alex Counts, about how the smallest loan helped get them back on their feet, gave them self-esteem and a sense of purpose, when no one else would take a chance on them. If you have a heartbeat you will be moved by the stories of Amodini, Shandha, Queenesta, and Omiyale. Counts, who is President and Founder of the US-based NGO, Grameen Foundation, reverently gives a comprehensive history of how Nobel Peace Prize-winner (2006), Dr. Muhammad Yunus, defied all expectations and reached out to the poor in Bangladesh in the 1970's, empowering them to be entrepeneurs. It is a warm, engaging, balanced account of the pitfalls of doing what you know is right despite everyone telling you you're crazy. I love this book because it blends the human element with the academic, thus making micro-finance accessible to those of us who aren't trained economists. The theory behind micro-lending is so simple: empower the poor to pull themselves out of poverty and you change the world. Whatever the arguments against micro-finance are, I would venture to say this book could convert even die-hard oppositionists. Counts concedes that the system isn't perfect, but there is such accountability, and such a desire to serve its clients well, with integrity, that you're inspired to put the book down, find your nearest micro-lending institution and see how you can help further cause. I don't remember the last time I felt that way. YS

Great Stories, and a Call to Action

Published by Thriftbooks.com User , 15 years ago

This is a great book - it brings the human impact of poverty and the importance of effective solutions to a clear light. It's impossible to not feel connected to the women in these stories, and by relating stories of women in Bangladesh as well as Chicago, it also paints a picture of the universality of poverty and the potential and need for microfinance to grow as a solution. One of the most important insights in the book is the analysis that the author hints at of the limitations to date of microfinance in the US due to outdated and inflexible legislation. This book leaves the reader with a frustration at these limitations, and makes it impossible to not want to see microfinance take giant leaps in scope here and around the world.

WARNING: This Book Might Encourage You To Change The World

Published by Thriftbooks.com User , 15 years ago

Alex Counts is one of those rare visionaries who also has the gift of storytelling. As you read the histories of the women in this book, you'll be captivated both by Counts' empathetic connection with them and his passion for the work of Grameen. The author is straightforward about the struggles and successes of a movement which has become one of the most powerful weapons against poverty in our time. After reading it, don't be surprised if you start chasing harder after your own big dreams.

What a story!

Published by Thriftbooks.com User , 15 years ago

I've been interested in microlending since I first heard to Muhammad Yunus 20 years ago. This is a great story of a great breakthrough by an author who was actually there with Yunus when they rolled this out. If you read the earlier Give Us Credit, this is updated in the personal stories and the worldwide spread of this idea. I loved it.

Small Loans, Big Dreams

Published by Thriftbooks.com User , 16 years ago

Dear Friends, I have just finished an amazing and inspiring book that I'd like to make you aware of - Small Loans, Big Dreams - by my good friend, colleague, and advisor Alex Counts, President and CEO of the Grameen Foundation. For those of you who may have read his other book - Give Us Credit - you will love catching up with some of those women from Bangladesh and from Chicago he brought alive in 1996. Women like Shandha, the "mother hen" of her credit center whose son became one of the first recipients of Grameen's high education loan and has now completed his master's degree. Or Omiyale and Queenesta, two African-American woman living in Chicago who were part of a solidarity group called Les Papillons (The Butterflies). You'll love getting caught up with how their lives have been evolving as they continue to face the obstacles and bumps in the road that the poor all over the world face. Even if you didn't read Give Us Credit, you'll love reading about these women and their struggles now. Alex is an amazing storyteller and you quickly get caught up in their lives as they participate in microfinance programs half way around the world from each other. You see so quickly just how microfinance transforms lives, although not always in the nice, neat way we would like to see it function. Alex is nothing if not honest as he lets his subjects' stories unfold. It is fascinating to see the intertwining of the modifications the Grameen Bank and other microfinance institutions have made over time and the lives of real people as those changes affect their lives and their choices. As Alex says, ". . . their uneven but steady progress has reaffirmed my belief in microfinance, and also my desire to ensure that the model continues to improve and serve the poor better through more responsive products." At the same time, this book is not just about these women. Rather, it is fundamentally a book about how Professor Muhammad Yunus and the microfinance movement are changing the world. Throughout the book, Alex provides his own insights into microfinance as it has evolved from the origins of the Grameen Bank to that of a broader social and business movement. After reading the book, you will understand much better why microfinance is today at a crossroads, what the divisions are about, and why Fonkoze in Haiti keeps its focus on the core business of microfinance - reducing poverty - by refining and extending the tools (whether financial, educational or health care related) that it makes available to the poor, wherever they are on their journey out of poverty. This is a big book about small loans that will help you understand the gigantic movement they have spawned. When you get the time, do pick it up and take a peek inside . . . it won't be easy to put it back down. Enjoy! Anne Hastings Fonkoze Haiti