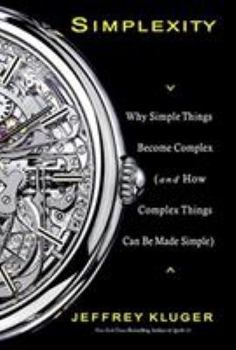

Simplexity: Why Simple Things Become Complex (and How Complex Things Can Be Made Simple)

Select Format

Select Condition

Book Overview

Why are the instruction manuals for cell phones incomprehensible?

Why is a truck driver's job as hard as a CEO's?

How can 10 percent of every medical dollar cure 90 percent of the world's disease?

Why do bad teams win so many games? Complexity, as any scientist will tell you, is a slippery idea. Things that seem complicated can be astoundingly simple; things that seem simple can be dizzyingly complex. A houseplant may be more intricate...

Format:Hardcover

Language:English

ISBN:1401303013

ISBN13:9781401303013

Release Date:May 2008

Publisher:Hachette Books

Length:336 Pages

Weight:1.05 lbs.

Dimensions:1.0" x 6.0" x 8.3"

Age Range:18 years and up

Grade Range:Postsecondary and higher

Customer Reviews

5 ratings

A surprisingly interesting read.

Published by Thriftbooks.com User , 14 years ago

A surprisingly interesting read. Very good reference material and theories on risk psychology with supporting/relevant case examples. Essential support content for those charged with the identification, assessment and classification of risk and the perceptions/challenges with the target audience to which you are communicating the findings. Specifically, the elements around the psychology and social influences regarding emergency building evacuations and egress routes for urban planners is very helpful for crisis planners and simulation planners alike

Zero-intelligence investors instead of perfectly rational presumption

Published by Thriftbooks.com User , 15 years ago

1. Blake Lebaron at Brandeis University has built a stock market virtual market allowing him to stimulate behaviors of bull, bear, static, active, and mixed and then release simulated investors into the environment. When someone tries a new strategy and do quite well, other will notice. Pretty son, a few more are trying it and it starts to become popular, a fad. Ultimately everyone starts converge on that strategy and it dominates the market, precisely the way real markets behave. 2. Economic models assume perfect rationality, of a universe of logical people all doing what they can to master their utility. 3. Investors react not so much to variables that are in their interest, but, oddly, to those that are in everyone else's interest. When the tide o the market shifts, most investors shift with it. Investors are often fooled by trends. John Miller of Carnegie Mellon call this mentality, "zero-intelligence investors"; physicist studying economics begin with the assumption that people can't think." Initially markets become to stable and robust then it collapses into instability. Researchers have turned to the behavior of fish to learn more how traders conduct themselves. 4. Simon Levi study fish management in a fluid, studying the speed, motion, and population size of schools of real fish. They found fish travel within a single body length of another fish to remain cohesive. If they get to close they collide and compete or drift to far apart and stand out too be seen by a predator. In an average school, it only takes 5 percent of the informed individual knowledge in the proper route to set the direction for the other 95 percent. As the school grows the leader size diminishes. It only takes a few individuals to set off a set of complex behavior. 5. Doyne Farmer wonder it would be possible to predict the volatility of markets by modifying an equation physicist used to determine the press sure of a gas in a box. Markets can blow up and it would be nice to predict before it happens. Farmer looked at price the stock sold for, limited orders, frequency of canceled orders. As markets order increases the volatility, the limit orders decrease the volatility, both behave like atoms bouncing around in a box. Canceled orders serve the same function as radioactive decay. Market volatility can be predicted. Farmer said, "We're not concerned with people's rationality or their reasons for placing the trades they do." Farmer observes that even stable markets drift from equilibrium toward some kind of periodic collapse like geology drifts toward earthquake or meteorologic systems drift towards hurricane. Energy is being pumped into the system. 5. Murray Gell-Mann accepted the challenge to solve what make something complex or simple. 6. Complexity, as both a scientific and social concept, is arguably more powerful than anything that comes out of a political institution. 7. How hard is it to describe the thing you're trying to understand?

Fascinating Perspective on the Complexities in Life

Published by Thriftbooks.com User , 15 years ago

If you liked the book Freakonomics, you'll enjoy this one. Also, economics, complexity theory, chaos theory, fractals, evolution, randomness, medicine, the arts, the humanities, politics and several others are touched upon here. Well written, well researched, and each chapter topic is concise, full of fun concepts and intelligently, thoughtfully addressed.

Everything should be made as simple as possible, but not simpler.

Published by Thriftbooks.com User , 15 years ago

Lately, we've been getting a large amount of good writing on interesting topics. Memoirs have been interesting, but my recent favorites are new new journalism's microhistories and science/economics/business cross-over books. Simplexity sits on my bookshelf with Gladwell's The Tipping Point: How Little Things Can Make a Big Differenceand Blink: The Power of Thinking Without Thinking, Levitt and Dubner's Freakonomics [Revised and Expanded]: A Rogue Economist Explores the Hidden Side of Everything, Ariely's Predictably Irrational & Taleb's The Black Swan: The Impact of the Highly Improbable. Although an interesting book, I would prefer more bibliography, sources, and a tad more depth. In someways Simplexity reminds me of Gleck's 1987 book Chaos: Making a New Science(has it really been over 20 years?) without the abundant source material. I will avoid the cliched impulse to say the book was "overly complex" or "too simple." I will also avoid the already overused review of "Kluger has made a complicated subject simple." Kluger has, however, done what I would want him to do well. He has explored and illuminated a new theory and a new concept in such as way as to make me rethink several assumptions I've had about business, life, and the way things work. He's given voice to things I've always known or understood, but never quite realized I knew. Those quiet, simple truths often are the hardest to find.

If you liked "The Tipping Point"... You'll Love This One!

Published by Thriftbooks.com User , 15 years ago

Time magazine writer Jeffrey Kluger deserves high marks for his latest non-fiction work, "Simplexity" -- even if he does stretch the truth occasionally for the sake of entertainment. I hope you enjoy it as much as I did. "Simplexity" fits nicely in the growing category of books I call "pop behavioral economics." Other notable entries in this group include "Freakonomics," "The Tipping Point," "Blink" and "Predictably Irrational." If you enjoyed any those books, you'll love this one, too. (A note to cranky academic types: This is a mass market book for popular audiences -- not a Ph.D. thesis or university monograph. Yes, it could have included 50 pages of references, footnotes and a full bibliography, but lighten up, friends. This book's written for NON-geniuses like me.) Kluger, who also co-authored "Apollo 13," has a deliciously smooth writing style and sense of pacing. He never lingers too long on any single example, instead propelling us ahead through the shadowy world where chaos and conformity collide. For example, we learn why it's so hard for the average person to make a killing in the stock market. And why just a few thousand cars can bring NYC traffic to a standstill, despite the metro area's amazing highway infrastructure. Other sections of the book deal with health care spending, sports, marketing, fine art, building safety and fear patterns. It's a veritable catalogue of human irrationality on parade -- just the kind of thing that upsets traditional economists and old-school psychologists. Kluger's main point is this: We live in a world that is often far more complex than it seems on the surface. Yet our minds are hard-wired to seek out simple explanations, even if those explanations are inherently wrong. At the same time, we often create complexity where none needs to exist, with sometimes horrific consequences. My sole criticism of "Simplexity" is the author's occasional loose hand on the truth meter. For example, he says early on that the Reagan administration was a 7-year period of almost continuous economic prosperity and growth -- until Treasury Secretary James Baker uttered the wrong words on Oct. 15, 1987, causing the great stock market crash of that year. Ummm...not quite, Jeffrey. The first two years of Reagan's presidency were very rocky on the economic front. And the market was poised for a fall long before Baker met with his German counterparts in Bonn to talk about currency levels. History is never that simple, alas. BOTTOM LINE: Great book. Lots of fun. Take it with a grain of salt. Enjoy!