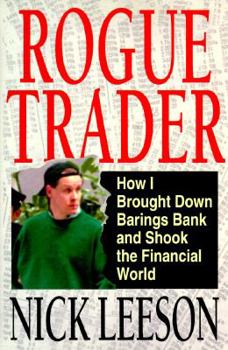

Rogue Trader: How I Brought Down Barings Bank and Shook the Financial World

Select Format

Select Condition

Book Overview

When Leeson was arrested in 1995 for bringing Barings Bank to its knees, it initially seemed as if he had single-handedly crushed the company. Indeed, it was he alone who found himself in the dark... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0316518565

ISBN13:9780316518567

Release Date:January 1996

Publisher:Little Brown and Company

Length:272 Pages

Weight:1.30 lbs.

Dimensions:1.1" x 6.4" x 9.5"

Customer Reviews

5 ratings

Leeson's Lessons

Published by Thriftbooks.com User , 16 years ago

As it turns out, Nick Leeson does not seem to be a terrible guy, although he single-handedly caused the collapse of one of the oldest banks in the world in early 1995, Barings Bank. I just don't understand how he could let the 88888 account continue for so long once the losses started building. Why not confess? What started with some mistakes and an attempt to hide them soon took on a life of its own and grew out of control. Sure, Barings should have had more internal controls and could have monitored Leeson better, but to think that a young kid from suburban London would outwardly forge reports and signatures to cover his trail is unbelievable. It was fraud and he knew it. This book is an interesting account of the collapse of one of Britain's oldest and most powerful merchant banks by Nick Leeson while trading derivatives on the Singapore, Nikkei and Osaka stock exchanges. Leeson recreated conversations and the year leading up to his capture with amazing detail, all of which makes for interesting reading. I was interested in the underlying reasons for the collapse of Barings, and thus, the book did drag on a bit. But once Leeson realized he would be discovered and fled Singapore with his wife in late February 1995, the story really got exciting. All in all, an interesting self-account of how covering one's mistakes will lead to lies upon lies, which, as it did with Leeson, will ultimately lead to disaster.

Good story, but not particularly "vindicating."

Published by Thriftbooks.com User , 22 years ago

I guess, in order to create some overarching conflict, and keep the story from looking like one long apology, Leeson had to dwell on the issue of management controls. This, however, would only seem a sound line of inquiry if he could actually prove the controls would have any value, absent his own activities (and questionable character). An organization as (historically) successful as Barings had been, particularly in an industry as competitive as merchant banking, will dispense a significant amount of discretion to mid-level managers in-order to facilitate innovation and risk-taking, two activities paramount to success in merchant-banking. Therefore, Leeson can't possibly have been alone in enjoying his level of localized discretion, at that or any other time in Barings' history, though HE ALONE misused it to such catastrophic results. Perhaps, then, the question is not should we check better on our employees' actions, but should we even hire employees that we aren't 100% sure could effectively utilize our level of discretion? While Leeson apparently acted in order to retain his leadership position, he effectively revealed his inability to lead by: 1) Creating a culture, within his office, of sloppiness and irresponsibility. (By allowing employees to utilize the 88888 account, rather than condition them, either by reprimand or more aggressive training, against making so many mistakes.)2) Mistaking his superiors' TRUST of his own abilities for "aloofness," and thereby failing to properly utilize (rather than ABUSE) that trust.3) Never, ever, ever owning up to his mistakes, or actually devising long-term solutions to his problems (like, say, never using the 88888 account after the first two times he cleared the balances, or simply not putting his OWN trading errors in the account.) ------ All this having been said, however, Leeson's account of his activities, and his flare for storytelling (or his co-author's, duh) make this a sufficiently enjoyable read.Aspiring traders in particular should probably read this story just in order to get a grasp of some trading concepts, as well as a general account of life as a trader (albeit a dishonest and irrational one such as Leeson).

Bankers will love it.

Published by Thriftbooks.com User , 24 years ago

A fast paced book, that could be mistaken for a spy novel. I found this book hard to put down, and as a younger reader I found the book very insightful, for the aspring Investment Banker.

Losing control, and losing money

Published by Thriftbooks.com User , 24 years ago

A lot of people lose control of something in their lives but eventually they cut their loses and walk away. Nick Leeson on the other hand loses control and keeps trying to fix the problem by virtually doubling down, until things spiral completely out of control. It is an interesting account how this man lost control over the 88888 account and brought down one of the world's oldest banks while upper management had no idea what was going on underneath them.

It could happen to anyone but like the lottery it never does

Published by Thriftbooks.com User , 25 years ago

Nick is a young normal intelligent guy that gets caught up in a web of deciept that he created. One should not feel sorry for him, for as this book explains he had the starring role in this play. His insights into what it like to be the star in a real life play that has a Shakespearean ending is interesting reading.