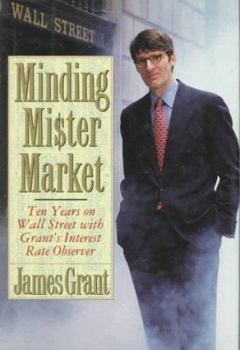

Minding Mr. Market: Ten Years on Wall Street with Grant's Interest Rate Observer

Select Format

Select Condition

Book Overview

Now in paperback--James Grant's comprehensive view of the 1980s, the least-inhibited decade in modern financial history, culled from the pages of his literate and incisive Interest Rate Observer. "A... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0374166013

ISBN13:9780374166014

Release Date:January 1993

Publisher:Farrar Straus Giroux

Length:424 Pages

Weight:1.60 lbs.

Dimensions:1.3" x 6.3" x 9.3"

Customer Reviews

3 ratings

The Apprentice

Published by Thriftbooks.com User , 15 years ago

1. Trump said he preferred to use other peoples money and debt was king. 2. Trump says he is focused on the downside implying holding reserves for some future downturn. Trump wants to build his trump city, upper side, New York. 3. The opulence of yachts, casinos, and towers are all for the show. 4. Late 1980s, Forbes put Trump's wealth at $1.7 billion. Trump loved the fact that the Japanese were buying real estate in Manhattan. Banks were pulling back credit, interest rates rose to 13 to 14 percent for Trump's Atlantic City mortgage bonds. 5. Trump as a real estate operator was heavily leveraged. Leverage magnifies volatility. In contraction, the direction of volatility, trump's affairs were likely to worsen. 6. Just as credit expansion lifted Trump's net worth, so contraction reduced it. 7. Trump lifestyle is income. A bear market may deplete even the prospective Trump resident. 8. The Atlantic City Taj Mahal when complete was expected to loss $1 million a day. Taj is four million square feet on 17.3 acres, estimated 24 million line of credit. 9. Based on the behavior of the past, could one predict that Trump would bankrupt in 2009? Trump says he would never take his companies public, but he changes his mind stating, it might be necessary to go public to raise money. Trumps opulence and greed over extended him making him vulnerable to massive financial downturns caused by the AIG, Bear Stears, and Lehman collapse. Trump should have held onto more reserves. 10. In 2009, Warren Buffet said US stocks are a logical investment when their total market equals 70% to 80% of Gross National Product. If Trump had deep reserves he could have bought low and sold high.

Insightful, witty analysis of the market and market players

Published by Thriftbooks.com User , 21 years ago

Mr. Grant's analysis and insight into market inconsistencies, anomalies, and absurdities is refreshing in this age of me too financial journalism. The articles, taken from Grant's Interest Rate Observer, are as original in thought as they are uncompromising in their logic. I am a finance professional and feel that this book is a must read for any young entrant into the field. This perennial bear can teach even the most ardent bull to reflect before they leap. Beware if you've been nurtured on Money Magazine!

Surprisingly good

Published by Thriftbooks.com User , 21 years ago

A series of vignettes from the early 80s to the early 90s. I love these "time capsule" books.Grant is a good author, and he is bearish, which is instinctually satisfying for most creatures.