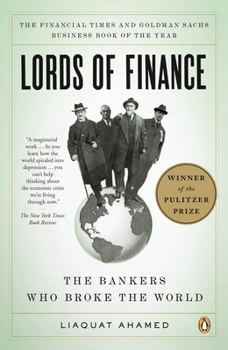

Lords of Finance: The Bankers Who Broke the World (Pulitzer Prize Winner)

Select Format

Select Condition

Book Overview

Winner of the Pulitzer Prize "Erudite, entertaining macroeconomic history of the lead-up to the Great Depression as seen through the careers of the West's principal bankers . . . Spellbinding, insightful and, perhaps most important, timely." --Kirkus Reviews (starred) "There is terrific prescience to be found in [Lords of Finance's] portrait of times past . . . [A] writer of great verve and erudition, [Ahamed]...

Format:Paperback

Language:English

ISBN:0143116800

ISBN13:9780143116806

Release Date:December 2009

Publisher:Penguin Books

Length:576 Pages

Weight:1.60 lbs.

Dimensions:1.3" x 5.4" x 8.1"

Age Range:18 years and up

Grade Range:Postsecondary and higher

Customer Reviews

5 ratings

Lords of Finance

Published by Thriftbooks.com User , 15 years ago

Liaquat Ahamad does a thorough and engaging job of describing the men and the factors that drove us towards the Great Depression. Its' scary to see that history is repeating itself as we see the collapse of the real estate and stock speculative bubbles. Its' amazing to me that the factors that caused the Great Depression, from the actions of the Federal Reserve, the control of the banks in restricting the flow of money, and the inability of the President to control the actions of these groups is largely overlooked. The easy way is to blame President Hoover and give FDR credit for ending it, when the truth is far more complex and relevant today as we face a similar crisis We have given the banks and Wall Street the freedom to take advantage of deregulation, and we are once again in a financial crisis. Only when you understand the past, can you prevent repeating it. Ahamad's book should be required reading for every Congressman and media member in the country. Only then, this crisis can be met head-on.

Massive Speculation leads to a Depression.Hoover got it right

Published by Thriftbooks.com User , 15 years ago

The author of this book has done an excellent job in analyzing what the main cause of the Great Depression was.The crucial pages in the book that provide the answer are pp.295-302.It is here that we find Benjamin Strong,in August of 1927, who knew full well that the United States was in the midst of not one ,but two raging, speculative bubbles,one in stocks and the other in real estate,forced through a one half of one percent rate cut that simply fueled the specultive bubbles even further.We find Herbert Hoover,blamed for the Great Depression in the United States,calling the future outcome one hundred percent correctly when he stated that the speculation of the late 1920's would lead to a Depression unless the banker financed speculative build up was stopped.Hoover's attempt to stop the insane rate cut failed.President Coolidge simply pointed out that there was nothing he could do because the Federal Reserve System was independent of the Federal Government.He stated that he had no authority to attempt to get the FRS to reverse the rate cut ,which they eventually did in February ,1928. Unfortunately,by that time that action was too little and too late.Only a policy of credit restriction applied against speculators might have mitigated the eventual depression. I highly recommend the book.It puts to rest once and for all the canard ,repeatedly told by Murray Rothbard and Milton Friedman,that the FRS was part of the Federal Government and was controlled by government bureaucrats who told the bankers what to do.It is just the reverse.The bankers were so powerful that they could tell an American president what to do.It is interesting to realize that the bankers have again brought the United States to the edge of financial catastrophe with their highly speculative loan policies

Central Banks in the First 40 years of the 20th Century

Published by Thriftbooks.com User , 15 years ago

First, let me say that this is an extremely well written book. I was expecting to have to plow through the usual dreadful writing that finance and economics seems to generate. To my surprise I found a book that was crisp, clear, and interesting. Fun, in fact. Second, the author covers a period and a topic that is sadly neglected in most histories - the inter-war period, and especially the financial events that played a major role in the rise of Hitler and the origins of the Second World War. The book is primarily the story of 4 Central Banks - those of the US, England, France, and Germany, and of the heads of those banks. The book actually covers a longer span than the inter-war period, it includes important information about the banks just prior to the First World War, their activities during the war, and extends into the Second World War. The lead-in is especially important, because it explains so much of what happened during the inter-war period. The events are too complicated to review in detail, but the author explains them well and shows how the personalities of the Bankers as well as the politics of the times influenced events. Let us just say, mistakes were made. My one quibble with the book is that the author is rather unsparing in his criticism of the bankers. Although this is somewhat justified, I ended up feeling sympathetic to at least the heads of the US Federal Reserve and the Governor of the Bank of England. Their primary fault was an inability to see beyond the conventional economic wisdom of the times. In point of fact, the only person who seemed to get it right during this time was Maynard Keynes. If we are to judge everyone against the standard of the most brilliant mind in their field, very very few of us are going to come out well. The most important point the book makes is how factors other than purely economic issues play a role in making economic decisions, but how the consequences of those economic decisions then rebound onto the wider political history of the times. While the book deals with a different time and political landscape, the parallels to our own times are VERY frightening. The author does not emphasize the parallels, and the book was actually completed before many parallel events occurred. To my mind that just makes them more compelling.

The Four Bankers of Apocalypse

Published by Thriftbooks.com User , 15 years ago

Liaquat Ahamed, a former World Bank economist and investment fund manager, began research on this book long before the current financial crisis, having no idea of the relevance it would have upon its publication. It is a history of the financial and economic turmoil that began in 1914 and didn't really end until after World War II. He traces the development of this crisis through the lives and actions of four central bankers: Benjamin Strong of the Federal Reserve of New York, Montagu Norman of the Bank of England, Emile Morceau of the Banque de France, and Hjalmer Schacht of the Reichsbank of Germany. The liquidity crisis of 1914 has suddenly become a subject of interest as it bears relevance to today's problems. Ahamed's central thesis is that the critical decisions made by these four bankers not only caused the Great Depression but also created the conditions for World War II. The most fateful event of all was the decision to adhere to the gold standard. In retrospect, tying the amount of currency a country has in circulation to the amount of gold it has in its vaults appears arbitrary and nonsensical. However, it seemed like a good idea at the time, it provided a universal standard against which countries could stablize their currencies. Unfortunately it became a straight jacket which gave them little room to maneuver. When the big four bankers came into power in the mid-1920s, the use of the gold standard actually seemed to be working, currencies were stabalized and capital was once again flowing. The problem however was that there was not enough gold in existence to proide enough capital to finance world trade. According to Ahamed, this was the central flaw in the financial system that led to the Crash of 1929 and the subsequent Great Depression. Of course, the chain of events was more complicated than that and Ahamed recognizes the complexity. Each of the four bankers and their respective countries were pursuing their own agendas as opposed to trying to save the system as a whole, the gold standard was the proverbial straw that broke the camel's back. Ahamed has written an interesting history of what otherwise would be a fairly dull story. It makes one think about flaws in the system - like sub-prime mortgages, derivatives and the excessive use of credit - and how things could have been different if they had been recognized earlier.

Four Men Could Have Prevented the Depression: Hopefully, Treasury Secretary Geithner and Adviser Lar

Published by Thriftbooks.com User , 15 years ago

Lords of Finance is a gripping story with forgotten yet worthy characters and villains hidden inside the drama of The Great Crash and Depression. It is a lively and fascinating "event by event" look at the slow motion lead up to The Great Crash, and the four men that could have prevented the Depression. Each thought they were pursuing a reasonable course (think prisoners dilemma), yet their tragic lack of vision and coordination doomed the world to a long and painful decade of decline. This book will keep you up at night (probably afraid for what is left of your IRA, portfolio, or home value) reading to find out what has happened to these four men and how they continually missed opportunities. In the end they were overtaken by their biases, rivalries, vacations and countries they represented: The United States, Britain, France and Germany. Falling stock prices, falling international trade, falling prices, falling commodities, a rush to hold dollars, declining interest rates but lack of loan availability, decisions to save some politically connected banks but not others, and a lack of consensus on an answer, all make 1929 and 2009 have an eerie similarity? Substitute a real estate bubble for fixed priced gold, reparations for sub prime, Treasury Secretary Henry Paulson for Treasury Secretary Paul Mellon, and the book reads like an echo of the slow motion days leading up to the Great Crash and the Depression that followed.