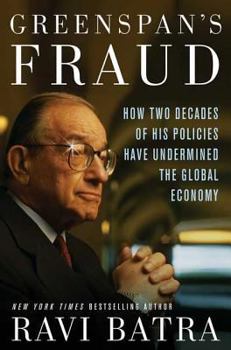

Greenspan's Fraud

Select Format

Select Condition

Book Overview

For two decades Federal Reserve Chairman Alan Greenspan has held reign over economic policy, outlasting three presidents. His long tenure has had a profound effect on global economics and on... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:1403968594

ISBN13:9781403968593

Release Date:May 2005

Publisher:St. Martins Press-3PL

Length:288 Pages

Weight:1.25 lbs.

Dimensions:1.0" x 6.4" x 9.5"

Customer Reviews

5 ratings

Just because you don't agree with Batra doesn't make it bad

Published by Thriftbooks.com User , 18 years ago

I don't see what all the fuss is from these negative reviewers who badly want to defend Greenspan's corporatization policies and support thereof which have resulted in more corporate dictatorships and poverty both here at home in the U.S. and around the world. Batra has coherently presented a book which links our current fascist anti-working class government to Greenspan and the corporate crony robber barrons on Wall Street. If you are sick and tired of the corporate fascism which has pervaded the U.S. like cancer for the past 25 years thanks to Greenspan, Reagan, Clinton, Bush I and II, and most Republicans and Democrats, this book is for you.

What does Greenspan have to show for his 20 years?

Published by Thriftbooks.com User , 18 years ago

More benefits to business cronyism and libertarian destruction of America. The media has always made it look as if Greenspan has and is always the economy's best savior even when it's never so. Maybe Greenspan could take some time off and visit hard hit areas such as my state of Michigan where his libertarian leaning policies or endorsement of them have turned my state into a nearly irreversable rust belt state like many other. Ravi Batra has the courage and confidence to break a window in Greenspan's fraud and you can expect that neoconservatives and libertarians along with their media cronies will be desperate in their criticism of this book at all costs. Read this book and flick Greenspan OFF !

A Tutorial in Economic History

Published by Thriftbooks.com User , 18 years ago

Ravi Batra is a Professor of Economics at SMU Dallas TX. This very readable book is partly about Greenspan's career in government, and politics, but mostly about the economic policies of the last three decades. Batra explains how the Federal Reserve has impoverished most Americans to enrich the wealthy, and attacked the middle class to benefit Big Business. Chapter 1 tells the real impact of Alan Greenspan, how he unwittingly effected a global crash and spread economic misery (p.5). Greenspan's [...] swindled millions of families (p.6), while he benefited from his tax policies. Chapter 2, one of the most important, explains the [...] that was used to raise Social Security taxes in 1983 and then squander this money on tax cuts for the wealthy (p.12)! Greenspan's [...]was that he helped to raise payroll taxes, then sought to lower Social Security benefits (p.36). Chapter 3 discusses Greenspan's worship of "free profits" (p.48). Adam Smith was against mergers of competitors, and government regulation to restrict competition (p.50). The fallacy of Classical Economics is they could not account for depressions of falling output and rising unemployment (p.60). Batra explains the fallacy of "Supply Side Economics" (pp.68-70). Chapter 4 explains "Greenspan's Intellectual [...]" (p.74) as deceiving an audience by using fake or selective data for monetary gain. Greenspan saved the country from a Reagan Depression in 1987 by flooding the markets with liquidity (p.91). Afterwards he raised interest rates to regain this money and prevent inflation (p.92). Chapter 5 reports the global effects of Greenspan's policies. The 1981 tax cut led to soaring interest rates and a steep recession (p.123). Cutting the interest rate resulted in higher stock prices (p.136). The bubble of speculation inevitably burst (p.139). Chapter 6 notes that economic theories can't explain the causes of a stock market bubble (p.141)! Batra says it is a mismatch between supply (productivity) and demand (wages and debt). When wages are high from productivity there is prosperity without a crash (p.143). Stagnant or falling wages create unemployment (p.146). Expansionary fiscal policies create a debt that comes due (pp.147-148). Regressive taxation and low wages create a global crisis. Chapter 7 explains how the income tax rate affects our standard of living. Reagan's tax cuts created a giant budget deficit and high interest rates (p.169). Clinton's raised income tax rates was followed by relative prosperity. Bush lowered the top income tax rate, which always hurts the economy and stunts economic growth (p.173). Chapter 8 documents another of Greenspan's [...], the claim that minimum wages create unemployment. This lie has been proven wrong since 1935. Greenspan wants increased immigration to keep wages down (p.191)! High money growth causes inflation (p.192). Chapter 9 discusses the trade deficit, which could cause the budget deficit (p.199). A country that exports goods has a trade surp

GREENSPAN CROSSES THE LINE TO PSYCHOTIC SCHIZOPHRENIA

Published by Thriftbooks.com User , 18 years ago

Pick a day of the week a throw a dart. That seems to be what decides whether Fed Chairman Alan Greenspan will tell us we are headed for disaster or doing fabulously on any given day. It has reached the point where it is not just fence straddling, but truly troublesome psychosis. And it has been going on for a while now. Look at this from last year. First, from May 6, 2004 comments to a banking conference: "Our fiscal prospects are, in my judgment, a significant obstacle to long-term stability because the budget deficit is not readily subject to correction by market forces that stabilize other imbalances." Then a few months later to the House Budget Committee: "The most recent data suggest that, on the whole, the expansion has regained some traction." One day he is pointing out that there is an "inverted yield curve," a little thing that precedes every recession and never appears except when there is a recession about to occur, and the next he is saying the economy is wonderful - even in the face of all obvious evidence to the contrary, such as seen in this Washington Post quote typical of the situation: "Greenspan was upbeat about the economy in remarks to the House Budget Committee, and did not suggest there would be any major changes in the Fed's monetary policy, which was a welcome relief to rate-wary investors. But the short-term cheer over his comments was not enough to allay the market's deeper concerns." The problem, though, is not Greenspan himself but something we see play out on a much, much larger scale, and which has the entire nation confused about the current state of the economy, which is actually very simple to explain. You see, it is the job of the entire investment firm profession to get you to buy stocks and bonds. And economists serve these people, and tend to be Republicans. The reality is that Greenspan and others understand the second part of the above Washington Post quote, that there are permanent "deeper concerns" due to the policies implemented by President Bush and the Bush/Limbaugh Republicans. The deficit is real, the declining dollar is real, that the lack of pensions are real, that record number of personal bankruptcies are occurring each year.. So why does the reporting and commenting go back and forth so much? Because they have to say something and to try and say something positive. They sit and wait on this and that report and then are supposed to make some comment based on these snapshots. If they were simply to continue to focus on the big picture, they would have nothing new or interesting - or very positive - to say. How many times can you write, "You can't keep running up the nation's credit cards like this?" How many times can you point out that the tax cuts were not targeted in any way toward job creation - they simply handed money to wealthy people without any incentives linked to increased hiring or any other mechanism of job creation. Lots of money was handed directly to companies, and so their profits

Greenspan is finally exposed

Published by Thriftbooks.com User , 18 years ago

Many people think that Alan Greenspan is the savior of the American economy. It's clear when you read this book that this is not the case. The reality that Batra lays out (often using Greenspan's own words) is often chilling and is timed perfectly with the recent spate of criticism of the Fed Chairman. What is really true is that Greenspan is an idealogue with an agenda aimed at helping big business. Batra presents an even-handed analysis that will make you think twice about any future pronouncements Greenspan makes about Social Security reform.