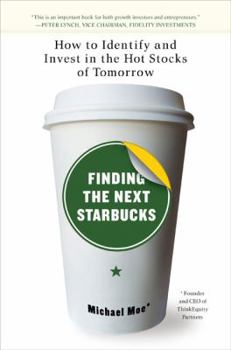

Finding the Next Starbucks: How to Identify and Invest in the Hot Stocks of Tomorrow

Select Format

Select Condition

Book Overview

Michael Moe was one of the first research analysts to identify Starbucks as a huge opportunity following its IPO in 1992. And for more than fifteen years, he has made great calls on many other stocks,... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:1591841348

ISBN13:9781591841340

Release Date:December 2006

Publisher:Portfolio

Length:374 Pages

Weight:1.30 lbs.

Dimensions:1.2" x 6.3" x 9.3"

Age Range:18 years and up

Grade Range:Postsecondary and higher

Customer Reviews

5 ratings

A guide to find the next megawinners

Published by Thriftbooks.com User , 14 years ago

Who doesn't want to find the next Starbucks or Microsoft? These companies are not easy to find, but they can definitely generate incredible returns. The author says that $1 invested in Wal-Mart when it went public would be worth $5,809 at the end of 2005. The author provides a recipe for finding these megawinners through ten commandments. He describes the process as a top-down approach versus the bottom-up approach used by value investors such as Warren Buffett. In the top-down approach, investors start with megatrends and industry drivers that are influencing the industry. Then a list of companies is generated. Based on the rankings he provides, the best ones are separated from the worst. Finally, the companies of choice are valued based on earnings growth and price to earnings to determine near-term and long-term attractiveness. Some of the megatrends listed in the book include the knowledge economy, globalization, consolidation, brands, and outsourcing. I enjoyed reading this book. - Mariusz Skonieczny, author of Why Are We So Clueless about the Stock Market? Learn how to invest your money, how to pick stocks, and how to make money in the stock market

Great Informative Book on Growth investing

Published by Thriftbooks.com User , 15 years ago

I could not stop reading this book. Lots of great examples on growth investments and how to look for them. Teaches you the properties of a great business. Examples in the last chapter compare big companies to one another and show what makes the big companies grow fast. Definately a great buy. Also gives references to other great books with single sentence reviews. Definately a must read book!!

a must have for aspiring investors/researchers

Published by Thriftbooks.com User , 17 years ago

the book lays a great framework for identifying investment ideas...very easy to read, simple but powerful, very engaging. I loved the interviews and industry discussions...a must read for investors, researchers and students alike.

Invest for the Future!

Published by Thriftbooks.com User , 17 years ago

Every amateur investor's dream is to find the "next big thing," but actually accomplishing this is harder than it sounds. Thankfully, Michael Moe's book has specifically laid out the industries that are likely to experience explosive growth in the future; and so that we can pick the right companies in those industries Moe has plenty of historical analysis about what other great companies did as they grew into present-day beasts. I especially like the comparative analysis at the end of the book that compares a successful stock pick (like Best Buy) to a bad stock pick (like Circuit City). Even though both companies look seemingly identical within the electronics retail industry the small but important differences are what this book teaches you to pick out.

Informative Perspectives

Published by Thriftbooks.com User , 17 years ago

Thankfully, this is not a "get rich quick scheme", and more importantly, the author doesnt indulge in self promotion or promote his partners/products. In an engaging discussion, the author tries to explain his underlying philosophy of investing - "earnings growth drives stock prices" - simple (to an extent, cliched, perhaps) premise. As simple as the premise is, the discussion behind that premise discovers some interesting aspects in the form of emerging trends and its impacts on investing. Trends like globalization and outsourcing have been mentioned by a million other authors, but Moe looks at those issues (and a few other megatrends) to identify potential developments in the investment landscape. Later, he discusses his 4P approach of evaluating a company (products, people, potential and predictability) - not dramatically unique, but discussed in an novel way. There is a pithy discussion on emerging Internet-business models and how it will impact consolidation, convergence, branding and other related issues. Towards the end of the book, Moe identifies some potential sector trend plays for investment - an excellent source of investment ideas. The discussion is interspersed with interesting interviews from a wide variety of people - academics to football coaches to fund managers. The companion website and the list of interesting blogs worth watching are an excellent resource as well. An informative, easy-to-read, and engaging book. A must have.