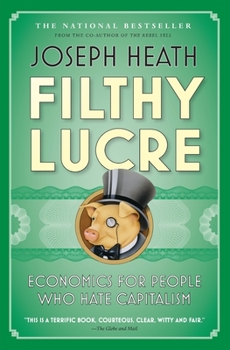

Filthy Lucre

Select Format

Select Condition

Book Overview

Economics is haunted by more fallacies than any other study known to man. -- Henry Hazlitt, Economics in One Lesson (1946) Every day economic claims are used by the media or in conversation to support... This description may be from another edition of this product.

Format:Paperback

Language:English

ISBN:1554683742

ISBN13:9781554683741

Release Date:April 2010

Publisher:HarperCollins Publishers

Length:352 Pages

Weight:0.70 lbs.

Dimensions:8.0" x 0.9" x 5.3"

Customer Reviews

3 ratings

Good high level arguments, quite sloppy details.

Published by Thriftbooks.com User , 14 years ago

I am socially liberal, very conscious of global warming and generally don't mind Canadian level of taxes to effect some level of universal access to education and health care. But I despair of Left/Green parties being able to manage a complex economy. So I mostly vote right, trusting that our checks and balances will keep the right from rolling back social liberties. I highly welcome this book, though I doubt it will have much effect on its intended audience, the Left. And I also doubt that the average Right voter will read it. Both would gain, though this book is an uneven effort. In each of his 12 chosen subjects, Mr. Heath mostly has the correct basic idea and addresses popular and distressing misconceptions (6 on the right, 6 on the left). He makes his point quickly and points out what is dangerous about those false beliefs. Where he gets in trouble, most of the time, is his analogies and his detailed opinions. Strangely, he seems better at dissecting holes in socialist dogmas rather than capitalist ones. Maybe because he is more familiar with them? His chapter on wage analysis is brilliant and so is his analysis of consumption. Contrast that with the chapter on taxes. Sure, there are goods and services that are best procured at an universal level so the State is best equipped to tax and fund them. Not necessarily to provide those services, but he doesn't see that (you can have publicly funded health or education, delivered competitively by non-governmental entities, for example). But he makes it seem as if governments stick to only those services that need to be purchased and provided collectively. If only. Still in the tax section, a rather silly statement that "no one cares about their taxes, only their gross relative salary". Is Mr. Heath that naive? People can emigrate when they see too much government takeaway, with uncertain value for themselves or for the community. I, and others I know, left France. Lots of Canadians left for the US in the 90s, what was then called the "Brain Drain", though some then realized that their lower taxes also meant more education and health care headaches. He cites Sweden, but neglects to mention that it is a model of Socialist success in Europe. It costs a lot, but delivers the goods. Some other European countries also have lots of taxation but don't deliver much value to their electorate, though their public sector employees can do rather well. Often, as I read, I got annoyed by the details while wholly agreeing with the overall idea. Reminding Libertarians that an efficient economy requires enforcement of rules is a case in point. It does, otherwise people will only trade with their close acquaintances. This is supposedly a reason for the elaborate socializing required in Asian businesses until recently - you'd better know your associates if you can't expect the state to referee efficiently and even-handedly. But he then messes it up with a comparison to fish tail lengt

Great at Telling us What Not to Do; Poor at Telling us What To Do

Published by Thriftbooks.com User , 14 years ago

Joseph Heath is a philosopher who has studied a lot of economics. His exposition of economic principles is highly accurate, and he delivers his message with a rare sense of humor. Heath's natural tendencies are towards left-wing anti-capitalism, but experience has taught him the pitfall of the proposed alternatives to the capitalist market-place. He wants us all to get the message not so we will stop seeking a better world, but rather so that we will seek a possible rather than an impossible world. "Economic illiteracy on the left," says Heath, "leads people of good will to waste countless hour promulgating or agitating for schemes and policies that have no reasonable chance of success or that are unlikely to actually help their intended beneficiaries.'' (p. 5) He gives the example of a documentary on worker cooperatives in Argentina. "While the material is quite affecting and some of the footage is remarkable, the events of the film are presented in what can only be describes an intellectual vacuum...You would never know, watching the film, that there is an extensive economic literature on the subject of cooperatives---written by socialists and nonsocialists alike---dating back over a century, that raises serious doubts about the possibility of structuring an economy along these lines." (p. 5) Heath begins by asserting that there has been a real "end of ideology" narrowing-down in the past several decades of substantive disputes concerning how an economy should be run. "There is a stark difference," he notes, "between [the current] ethos and a time when mild-mannered, middle-class people actually thought it might be helpful to tear down various pillars of Western civilization and rebuild everything from the ground up." (p. 23) This is precisely the case, in my estimation. And for this reason, the standard ideologies of the Left and the Right are irrelevant and misleading in attempting to deal creatively with contemporary economic problems. "The scope of state action," Heath observes, "and the appropriate level of taxation cannot be settled at the level of political ideology; they now depend upon the answer to empirical questions concerning the occurrence and severity of collective action problems and the effectiveness of government in resolving them." (39) Oh, if only our ideologues of Left and Right only understood this, and turned their impressive intellect and social commitment to solving real problems in really solvable ways! Heath is duly critical of traditional economic theory's hostility to the notion that morality plays a role in the economy. "Levitt and Dunbar," he writes, "repeatedly draw on an invidious contrast between "morality"--described as "the way we would like the world to be"---and "economics"---the study of how the world actually is. The message is pretty clear: Morality is for girls. Economics is for tough guys, who are able to stare the world in the eye and come to terms with the things are." (p. 48) Even more pithy, he

The left's answer to Hazlitt?

Published by Thriftbooks.com User , 14 years ago

Joseph Heath is a Canadian philosopher at the University of Toronto. He wrote this book because he feels that economics is important and that those on the left have not spent enough time coming to grips with it. As a result they cannot spot the fallacies in the arguments of the right and they "waste countless hours ... agitating for schemes ... that have no chance of success or that are unlikely to help their intended beneficiaries." Don't be put of by the sub title "Economics for those who hate capitalism". This book is excellent and deserves to be widely read by everyone with an interest in economics which, as Heath points out, should be all of us. Heath deals to six 'right wing' fallacies and then subjects six 'left wing' fallacies to what he calls sympathetic testing of their economic plausibility. He discusses the role that governments play in setting the scene for markets, looks at incentives, competition, taxes, free trade and personal responsibility. He then examines pricing, profit, the impending 'collapse' of capitalism, equal pay, wealth disparities and leveling down. His discussions of the Peacocks tail as an argument against the market is flawed although his use of game theory payoff tables is excellent. He overstates the case for state as opposed to contract based intervention in market creation and enforcement of breaches of contract. However, in my opinion these are minor issues. His discussion on free trade is masterful and he has the grace to admit that he changed his mind on this from youthful opposition to free trade. Apart from a very light coverage of deadweight loss, his explanations of tax effects are excellent and his arguments for a social insurance model covering the welfare state provision of healthcare and old age pensions is thought provoking. He uses the 'moral hazard' argument to good effect when explaining a different view of personal responsibility and explains 'hyperbolic discounting' as the causal mechanism behind the apparent fecklessness of the poor. His discussion of some of the lessons from behavioral economics is clear and concise and his defense of the price mechanism would pass muster with von Mises. Along the way he skewers wooly headed thinking by Naomi Klein and John Ralston Saul. Buy this book!!