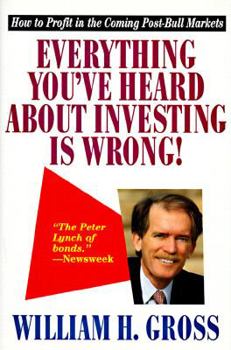

Everything You 've Heard about Investing Is Wrong!: How to Profit in Coming Post-Bull Markets

Select Format

Select Condition

Book Overview

One of today's best money managers heralds the onset of a new financial era, in which the rules for investors will be dramatically different. With wit and humor, Gross details recommended strategies,... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0812928393

ISBN13:9780812928396

Release Date:April 1997

Publisher:Crown Business

Length:193 Pages

Weight:0.85 lbs.

Dimensions:0.8" x 6.5" x 9.6"

Customer Reviews

1 rating

Bond Guru Shares His Wisdom

Published by Thriftbooks.com User , 16 years ago

What I Liked About It -- Shows how to THINK ABOUT INVESTING as opposed to providing rote formulas that will probably be misused -- Good brief overview of the yield curve and what that means for bond investing -- Great discussion on strategies for investing in low-volatility rate environment -- Enlightening discussion of the implicit "put" options in mortgages and corporate issues and how to take advantage of them -- One of the most human and enjoyable financial books I've read What Needed Work -- Will disappoint those looking for a bond investing "playbook" or formula -- Doesn't discuss in-depth strategies for high-volatility rate environments -- A bit dated in some aspects. -- Retail investors may not be able to apply these strategies without significant capital I've written an in-depth review on my enlightened-american.com website but here's the basic gist: All the great investors share some common characteristics -- an elegant simplicity, an ability to cut through to the essentials and an approach that integrates other disciplines or perspectives. Furthermore, the great investor-writers like Buffett, Greenblatt or Pabrai have that extraordinary ability to distill complex material into a comprehensible explanation that the average person can grasp. Bill Gross has all of this in spades and displays some of it throughout this book. Writing in 1997, Gross posits that a combination of high debt levels, expanding globalization and shifting demographics would mean slow-growth GDP numbers. As a result, investors should expect bond/stock returns of 6% and 8%, respectively, since corporate returns should eventually track economic output. He lays out a basic lesson in the yield curve, the case for disinflation and strategies for investing in a world of 6-8% returns. Along the way, Gross treats the reader to the pros and cons of corporate issues, mortgage-backed issues, emerging-market debt as well as more general concepts like macro-economic analysis, the famous PIMCO total return strategy and the plankton theory (especially pertinent in today's [2007] housing bust). As he discusses these potentially dull topics, he weaves real-life analogies into his explanations and as such, the book is entertaining to read while you're learning. Some of these analogies fit better than others (the Plankton Theory working best) but Gross turns a book about boring bonds into an investing page-turner -- an admirable feat. Highlights for me include the discussion of corporate and mortgage-backed issues. He outlines their inherent drawbacks and then illustrates why and how to use these features to your advantage in a low-volatility rate environment. I also liked his discussion of stretching short-term yield maturities so that you get a nice bump in yield with marginally increasing risk. I imagine that some may find fault with some of his predictions. Predictions are notoriously difficult and any inaccurate forecasting doesn't detract from the efficacy or validi