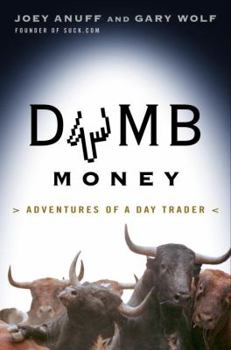

Dumb Money: Adventures of a Day Trader

Select Format

Select Condition

Book Overview

As you read this, five million Americans are day-trading. Not since gold was discovered in California have more people dropped out of their old lives and come running for the promise of a big score.... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0375503889

ISBN13:9780375503887

Release Date:April 2000

Publisher:Random House

Length:240 Pages

Weight:0.90 lbs.

Dimensions:8.5" x 1.0" x 5.8"

Customer Reviews

5 ratings

Entertaining, informative, scrumptious

Published by Thriftbooks.com User , 24 years ago

This is a quick read, as breezy as the sports page and as agreeable as a six-figure income before you're thirty. But beware. Underneath the adrenaline rush lie material angst and emotional depression. After reading this you may take a certain delight in writing yet another line of boring code or in picking up that phone and punching in the numbers as you puff yourself up for a cheery hello. You might even walk outside and admire the scenery, realizing that perhaps day trading is its own peculiar hell, the kind of thing the gods do to you when they grant your dearest wish.On the other hand this book might psyche you up to take the plunge or recharge you enough to catch the open tomorrow morning. If so--if you hear the siren call of the market or feel that passion for action--then this is a good book to read for what you can learn about how some day traders buy and sell. (They will be part of your competition.) There's a lot of insight here into what works and what doesn't work, or I should caution, what worked and what didn't work. It's clear that what day traders like Anuff do is follow the trend while working very hard to find a way to (glory be!) ANTICIPATE the trend. The incidental information on the significance of spreads, of just who you are playing against (add brokers and market makers to day traders) and how this passion may take over your life is perhaps the best of the book. Noteworthy is Anuff's description of the three-monitor layout and the software he used and the sites he visited while ensconced in his Frisco apartment glued to CNBC, whistling their theme song.Essentially "dumb money" is nonprofessional money. What Anuff learned in his experience as a day trader is that the market makers and the brokers and other professionals still have a big advantage. Although the playing field has leveled considerably in recent years, you still have the spread against you and your information is stale and second hand. Anuff says nothing about insider trading, but it doesn't take a genius to realize that it happens all the time. Note, if you will, prior to an earnings announcement, which direction the stock in question takes. Nine times out of ten the direction will anticipate the tenor of the announcement. If it sells off, you can be nearly certain that the news is not so good. If it inches up, you can bet that a rosy report will follow. How can this be? Could it be that insider knowledge leaked out ahead of time to selected individuals who traded accordingly, and that such action was in turn noted by market makers, brokers and others close to the scene who took advantage? Yes, it's against the law, but so is speeding on the freeway. Also not mentioned is the action ahead of a broker downgrade or upgrade. By the time you hear about it, the stock has already popped or taken a haircut. As poker players say, you're chasing.Anyway, Anuff, founder of Suck.com and Gary Wolf take us on a blitz tour of the day trader's world. Th

Caveat Day Trader

Published by Thriftbooks.com User , 25 years ago

The book is an interesting combination of one person's odyssey into and out of day trading, as well as a solid history of day trading. I thought that the joint perspective of the two authors was very helpful in conveying both how it used to be easy to make money in day trading (as SOES bandits hitting old bids and offers from market makers) and is much harder now. The reality described here is that almost all new day-traders can expect to lose a lot of money in the process of learning day trading (perhaps 30-50 percent of the inital stake, and some will lose more), and even those who make money will do so in a minority of the trades. This means a lot of psychological pressure on the day trader as loss after loss occurs. This pressure was beautifully described through Joey Anuff's relating a typical day while he was day trading. Since he lives on the West coast, this means getting up early . . . often followed by sleeplessness if he made big mistakes (like when he carried a large Oracle position overnight before a disappointing earnings announcement). The moments in between were often filled with tedium (listening to too much CNBC) and self-doubt (why didn't I hit the buy button in time?).For those who are not skeptical enough, the book provides a lot of insight into the motives of those who profit from there being more day traders (brokerage firms, market makers, those who sell tips and educational services, information providers, financial networks, etc.). The tone of the book is funny without overdoing it. Money is, after all, serious business to most people. In fact, it seems that most day-traders dream of becoming wealthy from this activity. Some will find the routine of a day-trader to be intriguing and exciting. Some will find it more than they want to handle.Anuff has a series of epiphanies that guide his journey. He is an early entrepreneur on the Internet, and is excited about its potential. Day trading looks like another way to cash in -- and he does on eBay. However, he later realizes that if he had just held his eBay rather than trading it, he would have met his financial goals. Reading about past market bubbles makes him concerned about an overpriced market, and leads him into becoming a day-trader (to avoid the risk of holding stocks overnight if the market melts down one day). He doesn't realize the other risks he is taking on until later.The essential fact of stock trading is that there has to be a loser for every winner except with IPOs. If there is a lot of dumb money out there, you can make money at their expense. Anuff likes that concept at first, but becomes uncomfortable with it when he realizes that he is sometimes the dumb money for someone else's profit. The loss of money and the ego blow are hard for him to take. Whether or not you are a day trader or considering being one, this is an entertaining book about one of the newest and fastest growing professions in the

dumb money

Published by Thriftbooks.com User , 25 years ago

Dumb Money is a great, honest, funny book. Anybody who day trades, even just the casual trader, will relate to this book. Very current with todays actions

Dumb Money

Published by Thriftbooks.com User , 25 years ago

Firstly don't write a review about a book you havent read--duh (like the guy above did).Secondly--I greatly enjoyed the book. I am not a day trader but I am intrigued by it. I learned a great deal about the history of the stock market during the last 15 years. I am less "dumb" for reading this book. The main morale I got from this book was not whether to day trade or not, but rather how the average online investor is being taken by the brokerages, CNBC interviews, and market makers.

Finally, a real look at daytrading!

Published by Thriftbooks.com User , 25 years ago

If you are considering daytrading, or need some comic relief to ease the pain from your daytrading losses, read this book. An easy read, this one portraits daytrading for a living as it really is. There are plenty of books about how wonderful trading life is. It sounds too good to be true and it is.I've always been partial to authors who have real life experience. This one does, you couldn't make this stuff up!Read it. Considering the potential losses in money and sanity, it may be your best investment yet.