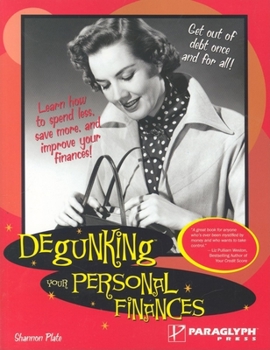

Degunking Your Personal Finances

Select Format

Select Condition

Book Overview

Most books about personal finance promise to make you rich overnight, or they make you feel bad about your past financial choices. They don't help you prioritize what you should do today, what you can... This description may be from another edition of this product.

Format:Paperback

Language:English

ISBN:1933097027

ISBN13:9781933097022

Release Date:April 2005

Publisher:Paraglyph Press

Length:350 Pages

Weight:1.31 lbs.

Dimensions:0.9" x 7.2" x 8.9"

Customer Reviews

5 ratings

Best book on finances!

Published by Thriftbooks.com User , 18 years ago

Finances sometimes being a difficult and stressful topic, I was extremely relieved at the ease of navigating and digesting the information in this well done book. The way the author uses humor and examples from her own experiences in her writing made me feel like I was sitting down having a conversation with a close friend. This book is the best I've seen on this topic!

Degunking Your Personal Finances

Published by Thriftbooks.com User , 18 years ago

I wish they would give a book like this to everyone entering college (before they offer all those credit cards!) This book offers great ideas on cleaning up credit and being more aware of the purchases you make. Like all the Degunking books, it is easy to read and not boring like most personal finance books! I definitely recommend this book to people who are trying to get a higher credit rating.

From a CPA's Perspective....

Published by Thriftbooks.com User , 18 years ago

I am a CPA and this is a book I would like to give to several of my clients and many of my client's children!! It's easy to read and has a common sense approach to handling the financial aspects that everyone encounters in their life. Fiscal responsibility is one of those things that many people have discussed and try to master, but very few are successful at. Degunking your Personal Finances is an easy and informative book to read, and will help you to become more organized and fiscally responsible. The firsthand "war" stories and tips help someone reading this to understand and relate to what the author is writing. This book is most beneficial if read from beginning to end, but is also very useful if you have limited time and you read the chapters out of order. I even found some tips that I will use to start finding some hidden money as the book points out. This one is a winner!

Help for the Helpless at last!

Published by Thriftbooks.com User , 18 years ago

I love this book! It is set up so that anyone can understand it, and the information is for real people. I especially liked the examples of different situations that the author shared. That made it easy to relate to my own life choices. It seemed that every scenario that a person could think of was covered, and in a consice style that is so appreciated, since I don't have tons of time to "study" a book. I found this to be a book that I could live by, from starting out to retiring. Thanks for such a great resource. Tracie Pratt Owosso, Michigan

Degunking Your Personal Finances

Published by Thriftbooks.com User , 18 years ago

Buy This Book for Chapter 6 Alone! A friend gave me this book recently because I've been having some serious difficulties with my personal finances. After a divorce and a move, I'm now a single mom raising a teenage son. My finances are really a mess. I've had to run up my credit cards in the last year as a result of a messy separation and loss of my husband's income, and setting up a household has been really expensive (especially now that we rely on only my income). The author's voice is reassuring and practical - I can see why she's a successful counselor! She's gotten me to take a long hard look at my finances, and I'm on my path to getting out of this financial mess I've found myself in. Chapter 6 is a godsend, "Degunking Your Consumer Debt." This chapter alone is worth the price of the book. The author emphasizes that you'll never degunking your personal finances until you commit to stop adding to your debt. Making that commitment has saved my finances. The rest of the chapter shows how to avoid new types of debt, chart out your debt, set up a way to start paying back debt, and deal with creditors. Chapter 3 is great too - it shows how to organize your financial life so you know where your money is going. I've always hated creating a budget, which is why I've never had one before. Shannon shows how easy it is to set up a budget and check in on it every other week (which coincides with my pay periods). It's much easier than I thought. And even though my mountain of debt looks really high right now, I'm already feeling better about myself because at least I'm back on a path to financial stability again. I've also shared this book with my son - who will be heading off to college next year. Having watched me wrestle with my money problems, I know he doesn't want to get into the same mess. This book is a great resource to teach you how to manage your money so that you don't get yourself in over your head. I think it's especially good for women who manage their household's finances, or for teenagers who need to learn about how to manage money.