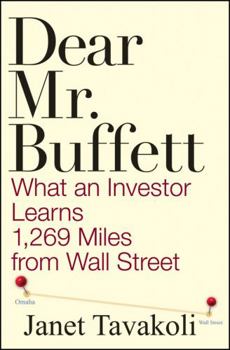

Dear Mr. Buffett: What an Investor Learns 1,269 Miles from Wall Street

Select Format

Select Condition

Book Overview

Janet Tavakoli takes you into the world of Warren Buffett by way of the recent mortgage meltdown. In correspondence and discussion with him over 2 years, they both saw the writing on the wall, made... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:047040678X

ISBN13:9780470406786

Release Date:January 2009

Publisher:Wiley

Length:304 Pages

Weight:0.05 lbs.

Dimensions:1.3" x 6.0" x 9.1"

Customer Reviews

4 ratings

The Sub-Prime Crisis: The Good, The Bad, and The Guilty

Published by Thriftbooks.com User , 15 years ago

Janet Tavakoli, a well-known expert in the world of credit derivatives and structured products (yes, those toxic assets) has written a remarkably entertaining and insightful book in which she combines Mr. Buffett's wisdom and advice with her own views about the credit crisis. Tavakoli's previous books, all about highly technical topics, allowed her to show only one set of skills, albeit an important one: her ability to explain technical issues in an accessible manner. In Mr. Buffett, however, a book for the general public that contains no formulas or equations, she demonstrates that she can write not only with clarity but with wit. Her prose is agile and precise, and her words punch her victims always fatally, and not once, but just in case, many times. Hints of this refreshing style were somehow present, although not totally in the open, in her previous book (Structured Finance & Collateralized Debt Obligations). Despite the subject matter she managed to include comments about triboluminescense, sexual positions, and the Nogorno-Karabakh dispute while making reference to characters as diverse as Michael Moore, Richard Feynman, Shakespeare and Paul Marcinkus. Mr. Buffett started with an invitation by The Sage of Omaha to Tavakoli in June 2005 ("Be sure to stop by if you are ever in Omaha and want to talk credit derivatives") after she had mailed him a copy of her latest derivatives book. Knowing that she would never have any reason to be near Omaha, Tavakoli volunteered a few days to visit. Shortly thereafter, she flew from Chicago (where she lives) to have lunch with Mr. Buffett in a place "with no décor but good food." That started a dialogue between the two of them (through subsequent phone calls, e-mails, and letters) that seems to be still going on. In a sense, Tavakoli's book is more about the current crisis rather than Mr. Buffett, although there is enough about him to satisfy the Buffett-curious reader. He comes across as a deceptively affable man who advises her not to neglect her love life, enjoys and values gossiping, reads financial reports the way a teenager reads Playboy, and believes there is no difference between value and growth stocks. This came as personal relief because I always failed to see the difference between them no matter how hard all the mutual funds prospects I have seen try to make that point. On a more serious note, Mr. Buffett seems not to take the Efficient Market Theory (or dogma?) too seriously. Not a surprise if you think that his track record as investor is a living proof of the fallacy of the theory. More important, Buffett reminds us of the danger of leverage: anyone can show great investment returns with leverage (inflated revenues, he calls them). It is when things go the other way, and leverage magnifies the mistakes, that you can really see who has been swimming naked. But the backbone of the book (and its most interesting aspect) is the critique and analysis of the current financial

Front Line Explanation of the Global Financial Meltdown

Published by Thriftbooks.com User , 15 years ago

This is the book that Wall Street and Washington do not want you to read. Many books will be written about the credit crisis but it is hard to believe that any will match this real time fast-paced expose. Tavakoli's 2008 book, Structured Finance, details the credit meltdown for finance professionals, and in this book she explains it in a way that everyone can understand. I agree with George Goodman aka Adam Smith who writes on the book jacket that that contrasting the madness with Warren Buffett's good sense is appropriate. He wrote Money Gameand identified Buffett as a great investor in the 1960's, before most people had heard of Warren Buffett. He also wrote a more recent book called Supermoney (Wiley Investment Classics). Contrasting the recent financial madness with Buffett's sensible warnings makes this book compelling, because it proves that the phrase "every one was doing it" is false. Tavakoli wrote the first book ever published about credit derivatives in 1999 and exposed hidden risks that worked in favor of investment banks but against naïve investors. That led to Warren Buffett inviting her to Omaha, and this book begins with that lunch. Tavakoli then uses his value investing philosophy and contrasts that with the subsequent market madness. There are a lot of hindsight bias plagued pundits who now claim to have spoken up, but if they gave any warning at all it was of the variety of "the sky is falling," with no specific understanding of what was happening. Some claim the events were unpredictable, but Tavakoli uses logic and facts, plus documented evidence that she said so back in the day, to explain that it would and did happen. She spoke out specifically and publicly about CDOs and wrote an early book, and the only book, to discuss the high degree of fraud and continued potential for fraud. In April 2005, she warned the IMF about credit derivatives and overrated CDOs and posted the clip on her web site. In January 2007, she wrote an article to a risk magazine saying risk managers at investment banks, and she mentioned some by name, should get out and sell the overrated securities. In February 2007 she wrote a letter to the SEC saying AAA ratings for many structured products were grossly misleading and the rating agencies should have their special status revoked for structured products. She issued a direct challenge to AIG's June 2007 accounting statements. It's all in the book plus much more. She also knew a lot of the people whose names made the news and interacted with them through the meltdown. One manager of the Bear Stearns hedge funds even tried to get her to change her public stance against their proposed initial public offering, which failed because she spoke out. Those facts make this book on the global meltdown unique, the only explanation from a pro who spoke out in a specific way in real time.

Clear, Accessible, and Witty

Published by Thriftbooks.com User , 15 years ago

I am not a finance professional, and my understanding of financial markets, especially derivatives, is basic, but I was riveted by DEAR MR BUFFETT. Much of it is because of Ms. Tavakoli's writing style: clear, accessible, and witty. Where definitions are needed, she supplies them, and her documentation is suburb. Despite the complexity of her topic, it was an easy read. In fact, she makes such a persuasive case that I came away from the book wondering why more experts didn't see the meltdown coming. At the same time, it was reassuring to know that Mr. Buffett's (and Ms. Tavakoli's) financial philosophy, ie not buying something unless you can pay for it, investing with caution, has prevailed. I would recommend this book to any investor -- large or small -- who's seeking direction for the future.

The Liar's Poker of Our Era

Published by Thriftbooks.com User , 15 years ago

The Liar's Poker of Our Era DEAR MR. BUFFETT is the "Liar's Poker" of our era, except that this book has the appropriate level of moral indignation regarding recent events in the financial industry. Janet Tavakoli reveals how we arrived at the current credit crisis, and shows how both trusted financial institutions and the current regulatory system failed to provide the necessary safeguards that allowed for such a crisis to occur. Through her conversations with legendary investor, Warren Buffett, Tavakoli provides a direct and insider-view into the credit crisis and engages the reader with her sharp, matter-of-fact style. Tavakoli contrasts Buffett's intelligent-investing approach with the unfortunate developments in the securitized finance industry. The book is definitely an eye-opener for readers who have not been directly involved in securitized finance. For those outside this industry, it is confusing as to why the credit markets so nearly completely unraveled in 2007 and 2008. This book provides the answer with fact after indicting fact. After reading Tavakoli's book, one realizes that the challenges of rebuilding our frayed financial system may be, unfortunately, on par with the challenges of rebuilding the U.S.'s physical infrastructure. Let the work begin, post-haste! [This review is based on an advance galley of the book.]