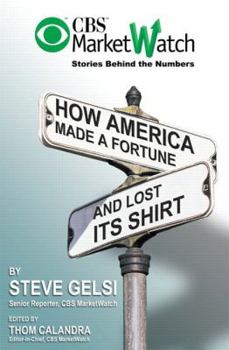

CBS Marketwatch Stories Behind the Numbers: How America Made a Fortune and Lost Its Shirt

Fifty-four percent of American households have a stake in the stock market. Most Americans did well in the stock market boom of the mid to late '90s, and some of them got rich. How do they view... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0028642619

ISBN13:9780028642611

Release Date:May 2002

Publisher:Penguin Putnam

Length:144 Pages

Weight:0.83 lbs.

Dimensions:0.7" x 6.1" x 9.5"

Customer Reviews

5 ratings

Reader

Published by Thriftbooks.com User , 21 years ago

This book isn't always hard-hitting, but it does bring up some of the hardships brought about by the bear market. With the pundits disgraced, it's helpful to see what every day investors have to say about the market. For Wall Street professionals, the book also provides a look into the minds of the folks they're trying to woo. The book doesn't promise to make anyone rich, but it does deliver rich lessons in the stock market from the perspective of Main Street.

A Great Antidote for the Wall Street Malaise

Published by Thriftbooks.com User , 21 years ago

The big talk right now - as I'm sure was the case in the late 1880s, the early 1930s and the 1970s - is whether confidence will come back into the equity markets. Well, time after time, America has always come back and has been stronger for it. It may certainly be tempting to get rid of all your stocks and go into bonds or something else that is "safe." Yet, history has a way of repeating itself and I'm sure the markets will yet again come back.The bubble of the late 1990s was a good thing, a reality check. Capital will now flow to the right places and there will be many reforms to make the financial system stronger and more transparent.Although the title of Steve Gelsi's and Thom Calandra's book may indicate they are only talking about the bubble, this is far from true. On a deeper level, the book focuses on America's core strengths -- especially the heartland. Ultimately, this is an optimistic book. In a way, the book feels like "On the Road" with Charles Kuralt. The language is simple but almost poetic. The stories are true and have lots of meaning. This book, in fact, would have made Charles Kuralt proud!

This little piggy went to market...

Published by Thriftbooks.com User , 21 years ago

Starting around 1982, and continuing on through the 1990s, this little piggy went to market. That is to say, Americans invested more capital in the US stock markets, and more often than they had ever done so in the past. People dreamed of cashing in big time on the likes of technology companies that marketed products that the common man clearly did not understand; or telecommunications companies whose stock prices defied the physical laws of gravity; or energy companies, where more than half of the accounting (and auditing) was "off the books".Fast forward to the year 2001, and market participants find themselves caught in the raging downdraft of a severe bear market. Gone are stock prices that are justified by some arcane measurement of productivity or valuation. Many of the highly touted companies of the 1990s find themselves at the doorstep of the bankruptcy court. Disgraced are the corporate leaders at those companies that knowingly chose to deceive their shareholders and the investing public by including sham numbers in their audited filings.Yes, Americans made lots of money in the 1990s only to lose most of it in the 2000s. Authors Steve Gelsi and Thom Calandra have created this book to document just a few of the personal stories that happened in the backdrop of the collapse of the US stock markets. Some stories are quite humorous, while other stories are not so funny. All are entertaining and well worth reading.We can learn from the good judgment exercised by other folks. We can learn from their failures as well. This book is light reading at its best, from two well respected journalists at CBS MarketWatch.

Great for the average investor

Published by Thriftbooks.com User , 21 years ago

I found this to be an extremely useful book that takes a non Wall Street approach to the market and offers common-sense strategies for the individual investor. It was a quick and easy read and provided an array of anecdotes that are geared at helping the average investor like me. I highly recommend this book to all individual investors who want to learn about how other investors are handling the volatility of the stock market.

A Time Capsule Worth Reading...And Remembering

Published by Thriftbooks.com User , 21 years ago

There will be another market bubble some day. But Enron, Tyco, Worldcom, and the rest of Wall Street's fallen giants have built a dark legacy for historians and investors who believed that stocks would never fall from their inflated levels of the 1990s.It is here, in the midst of that dark legacy that Gelsi and Calandra have provided a ray of light. These two gifted journalists have taken the easy flowing 'Net style of writing enjoyed by millions of readers of the seminal investment Web Site, CBS Marketwatch, into book form and have provided investors with an excellent account of the travails of the "person on the street" during that historic period in the stock market.The book is full of anecdotes and outside the box thinking that are written in a nice easy flowing style that won't bore and will provide plenty of humor and insight into how mass hysteria and hype can be shaped into a phenomenon, as well as its consequences when the house of cards crumbles.This is a very pleasant, short read, that is highly recommended for all who want to see the non Wall Street view of what took place in the greatest market bubble of all time, as well as to learn to avoid many pitfalls along the way.Joe Duarte author of "Successful Biotech Investing."