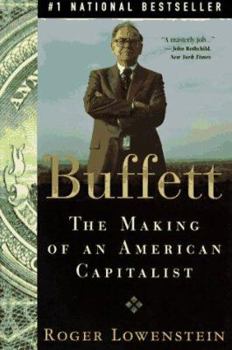

Buffett: The Making of an American Capitalist

Select Format

Select Condition

Book Overview

Since its hardcover publication in August of 1995,Buffetthas appeared on theWall Street Journal, New York Times, San Francisco Chronicle, Los Angeles Times, Seattle Times, NewsdayandBusiness... This description may be from another edition of this product.

Format:Paperback

Language:English

ISBN:0385484917

ISBN13:9780385484916

Release Date:January 2001

Publisher:Main Street Books

Length:475 Pages

Weight:1.15 lbs.

Dimensions:1.4" x 5.6" x 8.3"

Customer Reviews

5 ratings

The Business Genius as Everyman (Almost)

Published by Thriftbooks.com User , 15 years ago

Note: The review that follows is of the Second Edition. I recently re-read this Buffett biography (first published in 1995 and now re-issued with a new Afterword, dated January 2008) and then read Alice Schroeder's The Snowball: Warren Buffett and the Business of Life. Both are first-rate. Which to select if reading only one? That depends on how much you wish to know about Buffett's personal life, including his relations with various family members, and how curious you are about his personal hang-ups, peculiarities, eccentricities, fetishes, etc. If you can do without any of that, Roger Lowenstein's biography is the one to read. I also highly recommend the recently published Second Edition of The Essays of Warren Buffet: Lessons for Corporate America, with content selected, arranged, and introduced by Lawrence Cunningham. In fact, I'd now like to provide a brief excerpt from Cunningham's Introduction: "The central theme uniting Buffett's lucid essays is that the principles of fundamental business analysis, first formulated by his teachers Ben Graham and David Dodd, should guide investment practice. Linked to that theme are management principles that define the proper role of corporate managers as the stewards of invested capital, and the proper role of shareholders as the suppliers and owners of capital. Radiating from these main themes are practical and sensible lessons on the entire range of business issues, from accounting to mergers to evaluation." Lowenstein does a skill job of examining the context in which various lessons were learned, both by Buffett and by those with whom he was associated. In fact, one approach to his life and career is to examine in terms of student-teacher relationships such as Buffett's with Graham and Dodd as well as others' with Buffett, notably Katherine Graham and those who comprised the "Graham Group": Jack Alexander, Ed Anderson, Henry Brandt, Robert Brustein, Buddy Fox, David ("Sandy") Gottesman, Tom Knapp, Charlie Munger, Bill Ruane, Walter Schloss, Roy Tolles, and Marshall Weinberg. Munger is probably the most important of these associates for reasons best revealed in the narrative. It is worth noting that when Lowenstein was about to begin what proved to be three years of research and then the writing of this book, Buffett informed him that he would do nothing to block his efforts nor would he do anything to assist them. In the Afterword, Lowenstein recalls his first post-publication encounter with Buffett at Berkshire Hathaway's annual meeting in1996. Despite everything that had happened in Buffett's life and career during the previous 45-50 years, Lowenstein observes that "Very little in the portrait, and nothing in the investment profile, has changed." His consistency "may be his least appreciated trait." As does Schroeder but in somewhat greater detail, Lowenstein rigorously examines subjects that include: 1. The development of Buffett's business philosophy 2. His most important business relatio

An excellent financial biography

Published by Thriftbooks.com User , 17 years ago

Buffett is a fantastic biography on one of the 20th century's most well-known investors. Far from being just a financial volume or a how-to-invest-like-Buffett, Lowenstein's work is a genuine biography, and a very well-written one at that. That's not to say one cannot learn something about Buffett's investing style by reading this book; in fact, I believe I learned more about how the man has been so successful from this book than from any other source on Buffett. The great strength in Lowenstein's biography is that he highlights just what Buffett is-an anomaly. His success on Wall Street is unique, and not merely because that success happened from a couple thousand miles away in Omaha. No, Lowenstein recognizes Buffett for the remarkable man that he is, and analyzes Buffett's character in a way that, if you pay attention, actually explains how to "win" like Buffett has. Lowenstein highlights various attributes in Buffett's personality-his honesty, his amazing ability to keep things simple and find the "inherent value" in companies he analyzes, and his old-fashioned value finding approach to name a few-and examines them both in the context of Buffett's personal life and in his business life. The result is very intriguing, and the resulting impression is that Buffett succeeded on the Street because of who he was, both on and off. While this book may not spell out for you the criteria to invest like Buffett, it certainly shows, with great clarity, what kind of man it takes to be Warren Buffett. The fact that it's a very interesting read and an excellent biography only add to its appeal.

A REVELATION

Published by Thriftbooks.com User , 21 years ago

For me this was the best of about 6 stock market investment books I bought after selecting from a list of books touted by Morningstar.com as good reading. I read this book straight after reading Ban Grahams book, The Intelligent Investor. The latter is regarded as essential reading for security analysts, money managers, etc. but I found it relatively heavy going. Seeing Ben Graham was Warren Buffett's inspiration I thought it better to read this first before moving onto Roger Lowenstein's book about Buffett. Here, I saved the best until last because this book is mind blowing, even though all the principles espoused by the great Ben Graham are detailed in Roger Lowenstein's book. Therein lies the difference - this book is easy to read & Ben's principles, which Warren Buffett endorses, are put in a perspective, which hit you immediately between the eyes-just like a revelation.The first few chapters I found a bit tedious but once I had past these, the book was riveting. Whilst a biography, it has plenty of "how to" investment information & will certainly make you into a bettor stock market investor. It is the best book one can read if you have not done any investing in stocks yet-merely to avoid the mistakes & bad habits other stock investors have made & I speak for myself.One understands how Buffet avoided the Dot.com crash & why. Possibly the most interesting thing for me is that Buffet believes that NO ONE can call the market. He says its silly to rely on investment strategies like buying shares on a Monday is better than a Friday & that investing in small caps in December will likely reap you a fortune. And you should watch out for October. Whilst the latter comments are trite, there are huge numbers of books written exclusively about investment cycles & when to make calls - this book puts that technical stuff into perspective & for me this was tremendously thought provoking.I first read this book in December of 2001 when the tech. stock boom was on the wane. I was a committed "growth" investor until I read this book. I am now unashamedly a "value" investor. This book has completely changed the way I have thought about stock market investments & I am intensely relieved to have come across it before making more baseless investment decisions. I have read this book three times. I have since read about four other books on Warren Buffett's investment "styles" & this one is still the best.

Great reading - but only for those interested in business

Published by Thriftbooks.com User , 22 years ago

"Investment is most intelligent when it is most businesslike", Warren Buffett's teacher, Benjamin Graham, once wrote. This book is a fantastic biography of Warren Buffett. I think anyone who wants to learn about Warren Buffett or his investment techniques etc should first read this book before anything else (including his essays). This book is written time-chronogically, from the time around the early 1930s (Buffett was born in August 1930) to around 1994. Here we can observe how Buffett had a great desire to be rich since he was young, but in his teen years, after being involved in several business ventures, he longed for a method which is more consistent in making money. Meeting Benjamin Graham when he was 19/20 years old solved this longing for Buffett. He became a devoted investor in businesses since then. After working under Graham for several years, Buffett began a partnership (noticed how confident he was, despite his young age, to be successful) when he was 26 years old (in 1956) and achieved a 29.4% compounded annual return in the fund (he dissolved the partnership in 1969). During these 14 years, Buffett learnt which businesses (like those possessing customer franchise - Buffett called these with "Deep moats around the castles") were better than others. He dissolved his partnership in 1969 as he deemed the market to be very overvalued then.From then on, he used the lessons he had learnt to purchase great businesses at reasonable (or cheap) prices, such as Nebraska Furniture Mart, Washington Post, Cap Cities, etc. To fully enjoy this book, the reader should stop at certain chapters, and read other - yes, other - related books. For instance, around after I had finished reading chapter 3, 'Graham', I read Ben Graham's 'Intelligent Investor'. Also, when Phil Fisher was mentioned as one of the strongest influencers in Buffett's life, I read his book 'Common Stocks and Uncommon Profits'. The readers can get more insights from reading it this way. Mr. Lowenstein also took excursions when discussing Buffett to go through discussions about certain business characteristics, to ensure that the readers can fully appreciate Mr. Lowenstein's perceived motivation behind a certain Buffett action etc. Mr. Lowenstein also helped the reader to be more knowledgable about key points about US stockmarket history through interesting dissertations. I found these excursions extremely enlightening. Mr. Lowenstein's writing style is also very 'flowing' - he changed from one topic to another in a very smooth way. You've got to read it to understand what I'm saying. Lastly, I just want to say that the readers should have at least a moderate-to-strong knowledge and interest in business (and investing; but business = investing and investing = business) to fully appreciate this book. Enjoy!

Excellent reporting of a stellar investing philosophy

Published by Thriftbooks.com User , 24 years ago

This is the most influential account on investing I've ever read. It shows why Warren Buffett has been exceptionally, consistently successful on the stock market - because he has ignored one fad after another and stuck to the fundamentals and analyses he so cherishes. It's also an interesting personal story and an entertaining read.