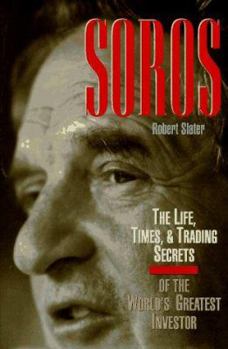

Soros: The Life, Times, & Trading Secrets of the World's Greatest Investor

Select Format

Select Condition

Book Overview

"A penniless survivor of the Nazi occupation of Hungary, George Soros is now one of the richest men in the world, and Robert Slater does an excellent job of helping us understand how Soros did it. . .... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0786303611

ISBN13:9780786303618

Release Date:May 1995

Publisher:McGraw-Hill Trade

Length:269 Pages

Weight:1.20 lbs.

Dimensions:1.1" x 6.3" x 9.3"

Customer Reviews

5 ratings

An interesting story book, but not for trading

Published by Thriftbooks.com User , 20 years ago

Although quite out of date, this is the most interesting amongst all other bibliographies of Soros I ever read. This could be attributed to that the author could not get direct info from Soros or his associates at all. Without the burden of returning any favor, the author could quote whatever and whoever (some ex Soros partners) he liked, particularly criticisms, which were the most interesting parts of the book. Other parts, like how Soros broke the Bank of England, how he identified with his Hungarian Jewish identity, how he failed to become a philospher and turned into a trader, should be good enough to satisfy most readers' curiosity on the early part (on or before 1994) of Soro's life. For those traders who want to know the trading secrets, go somewhere else. p.s. As a trader, I still would like to quote something from the book for my fellows' reference:-1. Page 60: What Soros understood better than most were the cause and effect relationships in the world's economies. If A happened, that B must follow, then C after that.2. Page 83: The stock market is always wrong, so that if you copy everybody else on Wall Street, you're doomed to do poorly. 3. Page 85: In 1979, Soros renamed his fund...Quantum Fund, in tribute to Heisenberg's uncertainty principle in quantum mechanics. That principle asserts that it is impossible to predict the behavior of subatomic particples in quantum mechanics, an idea that meshed with Soros's conviction that markets were always in a state of uncertainty and flux that it was possible to make money by discounting the obvious, and betting on the unexpected. 4. Page 92: Soros always says that you shouldnt be in the market unless you are willing to take the pain.5. Page 110: Short term volatility is greatest at turning points and diminishes as a trend becomes established. 6. Page 159: It is not whether you are right or wrong, but how much money you make when you are right and how much money you lose when you are wrong....If you have tremendous conviction on a trade you have to go for the jugular.It takes courage to be a pig. It takes courage to ride a profit with huge leverage.... When you right on something, you cant own enough.

Primer of Thought

Published by Thriftbooks.com User , 23 years ago

This book helps decipher the code of a great speculator. Financiers like Soros help keep the financial and economical mkt mesh in sync. Recent news on the dismantling of his Quantum (largest hedge fund in the world) and Quota funds has many on the street bewildered about his authority, but it should be understood that Soros publicly announced about two years ago that he no longer meddled in any of the funds' investments. This is a good book that explains the why's of a worldly speculator.

good book, bad character

Published by Thriftbooks.com User , 24 years ago

After reading this book, I thing the author was pretty neutral. But the conclusion is just one:these kind of investors are the synthesis of what rotten there is in capitalism.

Interesting. A must for understanding the great speculator

Published by Thriftbooks.com User , 25 years ago

Actually, this is the first of biography I reads about an investor. I am quite amased that I would enjoy it. I don't care what other people think of it or whether it is "authorized" or not. It tells a great story about the life of the great speculator from his early life, which shaped his investment and personal philosophy, onwards. It is a good book of introduction for understanding Soros investment theory -- "reflexism", because it kept track of facts, and put the rights and wrongs of his investment decisions in the frame of reality. It also recorded the comments from people worked with him. Thus, more objective or factual than "Soro on Soro", which is the next book I read about him. I also like what the author write about the collapse of British Pound in 1992. It gave details about how Soro formed his strategy and excuted it, with undoubtly a great success.

Incisive literature about the "World's Greatest Investor"

Published by Thriftbooks.com User , 25 years ago

Amazingly enough, I actually enjoyed reading this book. Not only was it informative, it also gave good insights into Soros's investment strategies and philantropic work. Still, since this book is an "unauthorized biography", I believe that a better product can be written by synthesizing the contents of this book with those of "Soros on Soros".