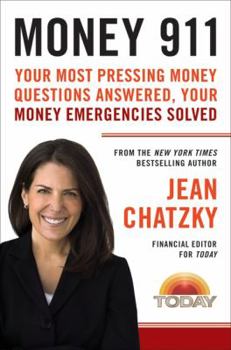

Money 911: Your Most Pressing Money Questions Answered, Your Money Emergencies Solved

Select Format

Select Condition

Book Overview

Jean Chatzky, the popular Today Show financial editor and Oprah contributor, shows readers how to navigate the critical challenges and universal conundrums of personal finance in Money 911. A lifesaver in difficult economic times, Money 911 answers the tough financial questions about how to manage your money in the face of life-altering events. Like popular personal finance guru Suze Orman, Chatzky offers clear, optimistic, timely, and intelligent...

Format:Paperback

Language:English

ISBN:006179869X

ISBN13:9780061798696

Release Date:December 2009

Publisher:Harper Business

Length:480 Pages

Weight:0.80 lbs.

Dimensions:1.1" x 5.2" x 8.1"

Customer Reviews

5 ratings

Entertaining and Informative

Published by Thriftbooks.com User , 14 years ago

Most people are caught in the middle of a huge financial storm that has damaged the financial structures they had built over and lifetime and were depending on for retirement. You may well be one of them. Jean Chatzky from the Today Show offers you sound answers to 130 money questions that may be just what you need to find some solid footing in working your way out of the present crisis. She deals with things ranging from repairing versus buying appliances, where to get the best credit cards, what to ask a prospective divorce lawyer (I hope you NEVER need one), and even tipping. You can see that this book has a broad range of interesting topics. Since you don't have to read this book from front to back, you can find and focus on just those questions that matter most to you. This is NOT an investment program. Nor does Chatzky offer you a system for getting out of debt and rebuilding your retirement. What she does offer is more immediate and focuses on the emergencies you face right. I particularly like the fact that she is very aware of the way financial predators try to confuse you and offer you dubious help while leaving you worse off financially. She tells you how to identify them, why you must avoid them, and how you can better handle the money issue these snakes are using to pressure you into a bad decision. The 130 questions are divided into 15 chapters that answer up to date questions on debt, money & life, protecting your family, identity theft & scams, budgeting and trimming your spending, credit, real estate & your mortgage(s), funding college for yourself, kids, and grandkids, insurance, retirement, saving & investing, career & work, taxes, marriage, and life's milestones. There is a helpful index and the edge of the book indicates each chapter by offset black edged pages. I also like the fact that the author not only answers the each question clearly and helpfully, but she also provides other resources for you to dig into the subject more deeply if you need to. Surprisingly entertaining as well as helpfully informative. Reviewed by Craig Matteson, Ann Arbor, MI

An Wealth of Knowledge

Published by Thriftbooks.com User , 14 years ago

there are tons of places to get information, but this is the most comprehensive and very good with respect to the what sources you can rely on to get some good answers, tips and a good place to start with at any stage of your budget life. I would recommend that everyone have this book in their library. Coupons means you have a budget and Jean writes in such a free style that it is easy to understand.

Wonderful book for college grads.

Published by Thriftbooks.com User , 14 years ago

Bought this book for my 25-year old step daughter who just began her first job as a teacher. I always loved Jean Chatzky's advice when she appears on the Today Show. This is a great book for my step daughter in helping her to learn how to be financially independent and responsible.

Speedy guide answers all your money questions - great and concise advice, so much better than surfin

Published by Thriftbooks.com User , 14 years ago

This is a great guide for you, if you're tired of the money management guides out there that assume that you're a complete amateur when it comes to money matters and go about explaining things like how to get a credit card and then use it responsibly. This book answers the questions that you can't usually find easily, especially in one place. To illustrate, the first section on Debt starts with "What is a debt settlement company?" and goes on to tell you what it might cost, some tools you can use to prioritize and pay down your loans and when to walk away from a debt settlement company. If you're like me, with some money management skills, but often have questions that you put into google search and then find yourself reading random answers from people on yahoo answers, then this is just the book you need. It takes a practical, question and answer approach to each money management topic asking only the most relevant questions and with no talking down. For instance,in retirement the first question is " I have nothing set aside for retirement, how do I begin?" Chatzky then takes you through various options in 2 pages and then goes on to questions like "Is 401(k) better than Roth IRA?" or "I am only 25, do I need to start saving for retirement?" or "I am a married stay at home parent, how do I save?" The author, who also has a show on NBC's Today show, answers similar questions on her show. It seems many of the questions in the book may have come from questions submitted to her by her viewers as they were not typical questions that would flow from the topic but real life situations that people would want to know more about. Example, the Identity theft section starts with "Could my child be a victim of identity theft?" followed by signs that may tell you if that is indeed the case. What I liked about the book is the fabulous organization: -Phone book like indexing in the right hand margin so I can jump right to the section I want to read rather than going through each chapter looking for info. - Broad coverage of topics - from Debt, Real Estate, Credit, Wills, Paying for College, Budgeting, Saving, Insurance, Retirement, Marriage, Career, Identity Theft, Money and Life (which has questions like tipping, 20% being the new normal for restaurants) - Concise answers but with the right detail to answer your question - a paragraph rather than a page in most cases. - "The Math" - quick, back of the napkin type math so that you can make your own calculations . For instance, "Calculate how much an electrical appliance will cost you to run it before you buy it" (in the budgeting section). - Wherever needed there is a "The Stats" section giving you the basic facts. Example, in Credit section it tells you what range of credit scores get you good credit and then "The Math" section demystifies FICO socre and how it affects a home loan vs auto loan. - "I also need to know..." section in each chapter that answers common questions that you may have, such as "How

Loved this book!!

Published by Thriftbooks.com User , 14 years ago

The things I like most about this book is the question and answer chapter formats and the easy to read investment tables. My daughter is a brand new Mother.. She will be returning to work in 1 month. There is a great chapter in this book re child care deductions and "Questions to ask a nanny /day care provider.." I ( as an over 50 consumer) especially loved the Retirement and "Saving and Investing " Chapters.. Each of the 15 chapters deals with a different aspect of keeping your personal finances on track in these trying times ... Jean has scored a winner with this 438 page book full of financial information for all age groups ..Buy it!!