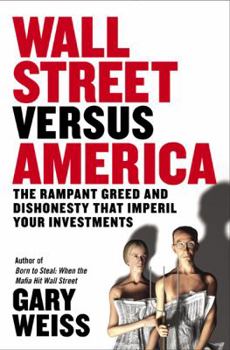

Wall Street Versus America: The Rampant Greed and Dishonesty That Imperil Your Investments

Select Format

Select Condition

Book Overview

A shocking appraisal that shows how Wall Street is intrinsically corrupt?and what individual investors can do to protect themselves For several years high-profile corporate wrongdoers have been... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:1591840945

ISBN13:9781591840947

Release Date:April 2006

Publisher:Portfolio

Length:290 Pages

Weight:1.15 lbs.

Dimensions:1.1" x 6.3" x 9.3"

Age Range:18 years and up

Grade Range:Postsecondary and higher

Related Subjects

Business Business & Investing Economics Finance Investing Personal Finance Politics & GovernmentCustomer Reviews

5 ratings

If you're a small investor, this book will make you cry.

Published by Thriftbooks.com User , 15 years ago

I recently received a small inheritance, and bought this book for some suggestions on what to do with it. After reading this scathing account of how careless, and frequently criminal, Wall Street is with investors' money, I think the best thing to do with it is stuff it in a pillow case and throw it in the closet. I looked at other reviews here to see if anyone in the know disputed any of Gary Weiss' claims, and, alarmingly, no one did. A former Business Week columnist, Weiss definitely appears to know his subject, and, more importantly, he adopts a tone that makes the book readable for a complete layman like myself. Though his style may occasionally come off as glib as facetious, he presents a view of Wall Street you are not going to get anywhere else, packed with information that pesents the world of investment as nothing more than an Old Boy's Club that simply doesn't care at all about you. Brief list of things I learned from reading this book: The regulation and punishment of criminals on Wall Street is usually done by the very people committing the fraud, hedge funds don't behave any differently with your money than any other investors, boiler room scams are alive and well (not hounded out of existence by the SEC, as I believed) and "punishments" meted out for criminal behavior by the SEC usually consist of being asked nicely to stop it. I can't recommend this book enough to anyone considering investing. I'm very glad I got it when I did. A Must Read!

"Bravo" from an ordinary investor

Published by Thriftbooks.com User , 17 years ago

I'm just an ordinary investor who has been feeling like a piece of bait for the securities industry- until now. I applaud you for Wall Street Versus America. Reading it made me realize that my concerns and suspicions are valid and that I'm not alone. Not only that, it provided the beacon I need to have the confidence to be aggressive with my questions, bold with my actions and to never again blindly follow the "advice" of a broker and never again exist only to have my portfolio's mission priority be to fill a broker's pockets ahead of mine. I am lucky to have learned this before Wall Street had a chance to ruin me. I was fortunate to retire with a pension lump sum. When I started looking into how to invest it, I found the brokerage industry to be like the Big Bad Wolf licking its chops, just waiting to brainwash me and take my money. So, I left my broker and found another, then I left the new one too. After that, I sold everything and put my money safely into Treasuries and Money Market funds so I could take all the time I needed to get my act together. Then, I found your book, bought it and read it carefully. Life changed. Thank you. Oh yeah, I said your book enabled me to be "bold with my actions". By that, I mean that I have already written to my congressman and to the chairman of the SEC to demand that Arbitration be made optional. I'm expecting little in return, or maybe some polite "baloney" but I'm not backing off. This absolutely feels like swimming up a waterfall, but it's a start. Great book.

A Work of Historical Dimension

Published by Thriftbooks.com User , 17 years ago

One of the most controversial aspects of "Wall Street Versus America" by Gary Weiss is the author's assessment that SEC Chairman Arthur Levitt was not the champion of the small investor as the press made him out to be; that, in fact, he aided and abetted the abuses against the small investor by refusing to curtail the corrupt practices on Wall Street. Weiss' assessment of Levitt is tersely summed up in the opening pages: "Levitt presided over the worst abuses to descend upon Wall Street since the 1920s. He failed miserably at dealing with the problems that he did not ignore entirely, but he did a couple of things better than just about any recent SEC chairman in history - give speeches, and court the press." And this is the crux of what makes "Wall Street Versus America" a work of historical dimension. Each of the Wall Street abuses detailed in the book, most of which continue to this day, were by themselves a fraud on the public investor. But together, they rendered Wall Street not a fair and efficient capital allocation system but an institutionalized wealth transfer system. No book has, heretofore, shown this so clearly. Wealth was sucked from the masses of little investors and transferred to the corporate and Wall Street insiders while the cop on the beat, the SEC, looked the other way. I recently retired after 21 years on Wall Street, during which time I made numerous written appeals to the SEC, the Fed, and in GAO testimony to halt the same areas of corruption covered in "Wall Street Versus America:" the rigged arbitration system; the 1920s style creation of conflict-riddled mega banks/brokerages; the rampant kickback schemes with lofty sounding names. One word aptly describes the outcome of each of my appeals: coverup. Thus, I am not surprised that Weiss has borne the brunt of threats and backlash for this comprehensive and courageous work. For those skeptics who can't believe that "Wall Street Versus America" is a keenly insightful and accurate portrayal of the corruption-riddled practices of the largest and most lauded financial system in the world, here's background to digest before you move on to the main feature: "Wall Street Versus America." In a 1994 article by Business Week (4/4/1994: Beware the IPO Market) regulators had the goods to clean up the systemic looting of American investors by bulge bracket Wall Street firms and their cronies. The article quotes Lynn A. Stout, professor of securities regulation at Georgetown University Law Center: "The IPO [Initial Public Offering] market is rigged. It's rigged against the average investor." The article goes on to define exactly how a "penalty bid" works. "This is a penalty imposed on brokers who flip or sell their customers IPO shares right after the offering. The practice, devised by a group of top Wall Street firms during Securities Industry Association meetings in the 1980s, is used by underwriters to help prop up the stock price of an IPO in the sensitive wee

Entertaining, informative old-fashioned muckraking

Published by Thriftbooks.com User , 17 years ago

A readable one-volume compendium of the many ways Wall Street can deplete your investment portfolio, written for a mass audience without sacrificing details. I found it to be well-researched and, though it has a strong point of view, balanced and fair in its presentation. The book is critical of regulation and takes a surprisingly antagonistic view of former SEC chairman Arthur Levitt, which it criticizes throughout for everything from mutual funds to Entron. The book also castigates Levitt's successor William Donaldson. I liked quite a bit this book's writing style, which was humorous and presented difficult subjects in an entertaining manner. The book contains one of the best explanations I have read so far of the mutual fund scandals, and goes beyond that to explain the various other ways mutual funds can rip you off. Despite the light approach, this is not at all like Michael Lewis's books. Lewis takes a laid back attitude generally agreeing with the Street's way of doing business, while this tome is outraged. In its style and presentation it harkens back to the Washington Merry-go-Round books of Drew Pearson and Jack Anderson.

Forewarned is Forearmed!

Published by Thriftbooks.com User , 17 years ago

Wall Street's system of resolving customer complaints allows no lawsuits- a defined system of arbitration is instead used. The Process takes about two years, and according to the NASD, investors win 53-61% of their cases. What they don't talk about is that any award, no matter how small, is considered a win. Parties pick panel members from lists compiled by NASD, proceedings are closed to the public, all papers (except for the final decision) are exempt from public disclosure and legal discovery and kept under lock and key, decisions are very uninformative - the aim is to provide no basis for a court to pick apart a decision, and decisions are almost impossible to appeal (unless the broker loses). There are only a few studies about small investors as stock pickers - the most dramatic is a study of 66,000 in 2000 which found that between '91 and '96 households underperformed the market by 1.5%, and the more they traded the worse they did. The average endowment manager lagged S & P 500 by 2% over ten years, according to the National Association of College and University Business Officers in '05. NASDAQ is a computer network; most stock markets today, from Tokyo to London, are also. The NYSE claims its manual system serves the public by specialists' buying against the market to help smooth fluctuations - academic research shows it mostly happens when the market is about to turn. Some analyst "research" is paid for by the companies covered. Academic research has found that picks by non-brokerage-analysts outperformed investment-bank analysts by 8.1%. Paid research is SEC required to so note, as well as the amount - they often don't, with little or no SEC reaction. Boiler rooms outside the U.S. sell Regulation S shares (must be held at least 1 year and sold outside the U.S.), receiving 70% of the take with the rest split between issuers and the stock promoter. Prior to '68 mutual funds were priced at the close of the prior day - thus, insiders could get easy gains by buying in today's up-market (without commission), and selling the next day. Abuses after '68 involved back-dating orders. One study found that of 361 funds in '76, 72 merged (usually because of crummy performance) and 37 disappeared within the ensuing 17 years. Most mutual funds under perform the market. The industry is not price competitive, allowing funds to pay brokerage firms for "shelf-space" (kickbacks). Hedge funds are a mystery to most. They typically charge 20% of profits plus 2% of assets/year. Restricted to investors with a new worth of at least $1 million, hedge funds can do most anything and often require investors to lock in their money for a period of years, and most under perform the market (eg. 8.8%/year in '95-'03, vs. 12.4% for the S & P). Further, most have "high-water" clauses (eg. if lose 10% in a year, must regain this amount before the 20% of profits claim - thus, many will simply close the fund in such a situation. Underwriting state and local