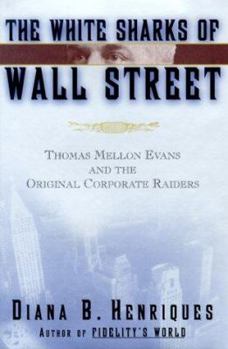

The White Sharks of Wall Street

Long before Michael Milken was using junk bonds to finance corporate takeovers, Thomas Mellon Evans used debt, cash, and the tax code to obtain control of more than eighty American companies. Long... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0684833999

ISBN13:9780684833996

Release Date:May 2000

Publisher:Scribner Book Company

Length:368 Pages

Weight:1.15 lbs.

Dimensions:1.1" x 6.5" x 9.6"

Customer Reviews

4 ratings

Interesting but somewhat unfocused book

Published by Thriftbooks.com User , 14 years ago

After a vibrant, if unregulated, boom in the 1920s American business entered into a relatively stagnant era during the 1930s and 1940s. By stagnant I refer not simply to the global economic circumstances but to the resultant conservatism and regulation. Given the lack of credit, high taxes and new securities regulation the number of mergers and acquisitions declined. In the 1950s the first "green shoots" began to appear and these financial operators are the subject of Diane Henriques book. Thomas Mellon Evans (1911-1997), a "poor relation" of Pittsburgh's famous Mellon family, was a serial acquirer in that era. Major proxy battles were waged by other raiders such as Louis Wolfson and Robert Young. Each of them were major "innovators" in regards to financing, proxy solicitation, minority shareholders etc. Rightfully these "innovators" usually required subsequent reforms of regulatory methods. An example would be the SEC's proxy solicitation rules which never visualized two or more parties taking opposing newspaper advertisements (i.e. did they have to be reviewed by the SEC as factual). Diane Henriques' is an established journalist and the occasionally complex issues are presented clearly. To my mind the book is unfocused inasmuch as it is 60-70% the story of Thomas Mellon Evans and 30-40% the story of the other raiders. If the book is about raiders in that era then much of the biographical detail about Thomas Mellon Evans is extraneous. Conversely, if the book is a biography of Thomas Mellon Evans, then much of the detail about the transactions of other raiders is irrelevant. The author tries to straddle both genres but, while most of the individual details are interesting, the overall effect is confusing.

A solid book on the history of corporate raiders

Published by Thriftbooks.com User , 22 years ago

I found this book to be filled with fascinating stories about Thomas Evans and other like him who changed the face of Wall Street in the 50's. As far as corporate raiders, most people only think back to the 1980's for when it began. This book will give you insight into how it all began half a century ago. It is not just a single story, but numerous ones about various radiers and the companies they targeted. For anyone who wants to learn about Wall Street history, this book is a must.

Must read financial history

Published by Thriftbooks.com User , 23 years ago

An important book that covers an overlooked era and subject.

If there was not blood to attract them, they created it.

Published by Thriftbooks.com User , 23 years ago

This book filled a gap for me in the history of Wall Street and some of its more colorful participants. I think there is a tendency for the more notable "raiders" and their like to be confined to the 1980's and 1990's, and as this book points out this could not be further from the truth.This book chronicles the exploits of men like; Thomas Mellon Evans, Lou Wolfson, and Leopold Silverstein. These individuals were out inventing the type of financial transactions that today are commonplace, and seem to have a rather brief history. The truth is that these; raiders, proxy fighters, liquidators, were using sinking funds, Leveraged Buy Outs, and Junk Bonds long before Michael Milken heard the term. In fact much of this took place before he and Ivan Boesky and their crowd were born.The book delves into specific deals that are enticing reading just by there names. In 1955 a complicated price-fixing scheme that included companies still doing business today operated a system known as the "phase of the moon".Shark-repellent, poison pills, greenmail, side deals, collusion were all in a days work. What was also interesting is these people never had their fill, many ending in bankruptcy court half a century after they had started.The did what they had to do to get what they wanted, and if that meant convincing a 90 year old woman to part with her shares, it was just another day in the trenches.I would highly recommend this book for anyone interested in Wall Street History in general, and the specific predecessors of today's big names. Long before "Chainsaw Al" there were men hacking away at companies that even he would have found audacious.The Authoress does a wonderful job of relating this History in a readable easily accessible format, which is well worth a reader's time. You will be amply rewarded.I don't know how Trump got in this; his contribution was an endorsement on the book jacket. Not one of his deals made the book.Great addition to your financial library.