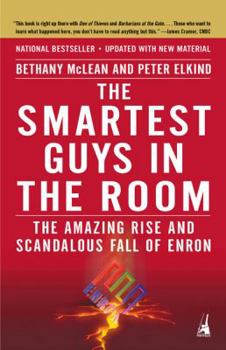

The Smartest Guys in the Room: The Amazing Rise and Scandalous Fall of Enron

Select Format

Select Condition

Book Overview

In this tenth-anniversary edition, acclaimed investigative journalists Bethany McLean and Peter Elkind deliver the definitive account of the fall of Enron, one of the biggest scandals in corporate... This description may be from another edition of this product.

Format:Paperback

Language:English

ISBN:1591840538

ISBN13:9781591840534

Release Date:September 2004

Publisher:Portfolio

Length:480 Pages

Weight:1.00 lbs.

Dimensions:1.0" x 5.4" x 8.5"

Age Range:18 years and up

Grade Range:Postsecondary and higher

Customer Reviews

6 ratings

This helped my business knowledge tremendously!

Published by Hannah , 2 years ago

I purchased this book to be used in my business ethics class. Since then, I have often referred back to this book and the lessons it teaches about the potential misuse of power, and the errors in judgement that often happen in businesses over time. This book was an easy read in comparison to other books overwhelmed with business jargon. I recommend this to anyone wanting to learn of the importance of business ethics.

The Guys Weren't So Smart After All

Published by Thriftbooks.com User , 18 years ago

If you have any interest in the sticky wicket of corporate ethics, you've gotta read this book. Bethany McLean, who wrote the original article that helped start the ball rolling on Enron's inevitable collapse, and co-author Peter Elkind have done a masterful job documenting the rise and fall of Enron, an energy company that was, more or less, a tissue of lies. The amazing things that stick out in my mind are how easy it was for almost all the participants in the unquestionable fraud that was Enron to justify what they were doing, to themselves and many others, before and even after the collapse. And how worthless it all was--most of them weren't very happy, even when Enron was riding high. And, for a few extra million bucks, they've pretty much made a mess of their lives. The authors seem incredulous that, after giving the copious documentation of poor management and outside fraud, that most of the former Enron executives consider themselves victims of everything except their own greed and incompetence. Yet does it surprise anybody that a company who was run by a management team that considered the most relevant aspect of Enron's business to be that "it was a really cool company" was, in fact, a mess? That the "loose-tight" management practices and Enron and praised by consulting firm McKinsey consulting were, in fact, all loose? McKinsey, a consulting firm that prides itself on radical management thinking and outside-the-box creativity (Tom Peters, one of McKinsey's most famous former employees, has made a very good living advocating management practices, and certainly attitudes, not so different from what Enron put into practice) has since tried to distance itself from its close relationship with Enron, and the authors don't pursue that connection very doggedly. But I am prone to wonder if, in a way, McKinsey isn't just as complicit as Arthur Andersen was in contributing to the debacle that was Enron. Although McKinsey didn't actively participate in the fraud, book-cooking, legal manipulations, and outrageous debt that eventually brought Enron down--at least, not directly--certainly the McKinsey attitude was exhibited all throughout Enron. Certainly, Jeff Skilling--as guilty as anyone in Ernon's downfall--would have been a proud McKinsey case study, before the fall. He managed Enron "loose-tight", he hired creative and talented people with no experience in the Energy industry, he "innovated" with all sorts of new non-managing management techniques. He was a McKinsey golden-boy. Somewhere out there, I'm sure there were some Tom Peters' seminars extolling the virtues of Enron's modern management and "super cool" corporate culture. The fact that the company cooked the books while leaking money all over the place not withstanding. But, Arthur Andersen is out of business and the company that probably contributed more to the mindset that eventually put Enron out of business is still doing pretty well. Too bad nobody at McKinsey or Arthur An

Corporate Character

Published by Thriftbooks.com User , 20 years ago

The authors describe a complicated critical mass of personalities that caused the Enron meltdown. McLean and Elkind have written a book about human behavior in a pressure cooker where top dogs vie for power. Enron executives cannibalized their own company with Wall Street's help. Financial engineering may have assisted these people, but their willingness to do it in the first place is a question of character. I also recommend a book that explains how structured finance can be used to funnel money out of companies and which explains Enron's disguised loans: Tavakoli's "Collateralized Debt Obligations and Structured Finance."

Human Frailty and Corporate Failure

Published by Thriftbooks.com User , 20 years ago

The authors have done a masterful job of describing the critical mass of complicated personalities that contributed to the Enron meltdown. McLean and Elkind are keenly perceptive about human nature at its worst, and paint colorful portraits of the personalities of Enron's top honchos. The behavior of Enron executives jockeying for position at the expense of their corporation is infuriating. Ripping off the investors is bad enough, but some of the executives cannibalized their own company with Wall Street's help. Financial engineering may have assisted these people, but their willingness to do it in the first place is a question of character. McLean and Elkind do a masterful job of implying the contributing elements of lack of character. This is a well written and fascinating book. This is not so much a book about finance as it is a book about human behavior in a social crucible where power and high rewards are at stake. This book will become a classic in business school ethics courses and organizational behavior courses."Collateralized Debt Obligations and Structured Finance" by Tavakoli will become the textbook of choice for any graduate school developing a course in this subject. It's clever in explaining structured finance including Enron's disguised loans. The author gives reasons why investment banks and sureties who aided Enron had their own failings in how they distributed internal social rewards. It's a structured finance text that warns against and suggests defenses to this kind of behavior and starts out saying that one should expect fraud and be prepared to diffuse it.

Who will be among the smartest guys in a federal prison?

Published by Thriftbooks.com User , 20 years ago

This book will be especially valuable to those who have a keen interest in "the amazing rise and scandalous fall of Enron." I also commend to their attention Smith and Emshwiller's 24 Hours: How Two Wall Street Journal Reporters Uncovered the Lies that Destroyed Faith in Corporate America. The "smartest guys in the room" included Kenneth Lay, Jeffrey Skilling, Rebecca Mark, Andrew Fastow, Kenneth Rice, and Clifford Baxter. Whereas Smith and Emshwiller explored the same company as investigative reporters, McLean and Elkind seem (to me) to have approached their subject as corporate anthropologists. Both books reach many of the same conclusions as to what happened...and why. Two significant differences are that Smith and Emshwiller limit their attention primarily to a period in 2002 extending from October 16th (when Enron announced huge losses caused by two partnerships) to December 3rd (when Enron filed for Chapter 11 bankruptcy); McLean and Elkind cover a two-year period of the company's "amazing rise and scandalous fall." Also, McLean and Elkind devote far more attention to each of the "smartest guys"; Smith and Emshwiller seem far less interested in them, except in terms of the impact of their mismanagement and corruption. Let's say there are two books about the collapse of the twin towers at the World Trade Center; one focuses on the human tragedies associated with it whereas a second book addresses design, construction, and structural issues. Obviously, both approaches are valid.McLean and Elkind suggest that the eventual collapse of Enron was caused less by the greed of senior-level Enron executives than it was by their arrogance and incompetence. Their lack of basic business acumen is astonishing as is their defiance of regulatory agencies and contempt for customers. None of them seems to have had a moral "compass." They exemplified, indeed nourished a culture of brutal competition between and among their subordinates. Each used Enron as a personal ATM as well as a means by which to structure all manner of corporate partnerships and high risk/high yield investments without fear of any personal liability. If one prospered, so did they. If it failed, the loss was Enron's. On to another. Primary blame for all this must be shared by Lay, Skilling, and Fastow. McLean and Elkind rigorously examine the inadequacies of each, suggesting that if only one of the three had not been involved, it is probable that Enron would not have had the problems it did. Attorneys, accountants, brokers (notably Merrill Lynch) and bankers (especially Citibank and JP Morgan Chase) apparently were aware of Enron's bending and then breaking of various laws but were earning so much in fees that they chose to remain at the Enron "trough" side-by-side with Lay, Skilling, Fastow, and other Enron executives. Consider this brief excerpt from Chapter 10 (page 149):Here's how another former employee explains the process: "Say you have a dog, but you need to create a duck on the f

Brilliant

Published by Thriftbooks.com User , 20 years ago

Like many, I followed the Enron disaster as it unfolded with a certain curiosity usually reserved for matters closer to home. Somehow, the more I learned, the more intrigued I became at the sheer magnitude of the arrogance, incompetence and irresponsible management displayed by executives who were surely thought to be `the smartest guys in the room'. Fearing the media at large was skewing the coverage afforded to Enron on a whole, I looked forward to a book or report that would serve as a definitive look into the entire Enron affair with the type of thoughtful and provocative investigation that "The Smartest Guys In The Room" provides. Having been extremely disappointed with another recently read Enron expose, I could not recommend "The Smartest Guys In The Room" highly enough. Not only do McLean and Elkind do an excellent job in uncovering the facts, they do so in a crisply entertaining and enticing manner that kept me interested and consumed the entire way through. From the opening chapter, the authors flush out the characters, establish the timeline and ultimately piece together an incredibly insightful story of greed, ignorance and outright superciliousness, worthy of anyone's time and attention. "The Smartest Guys In The Room" is an incredible section of work that deserves to be recognized as the truly inspired endeavor that it is.