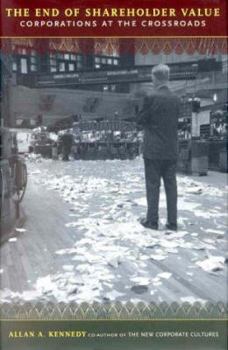

The End of Shareholder Value: Corporations at the Crossroads

Select Format

Select Condition

Book Overview

"Allan Kennedy provocatively proposes that running corporations to benefit shareholders damages companies and the societies they operate in. [He] has raised questions about managing for shareholder... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:0738202401

ISBN13:9780738202402

Release Date:May 2000

Publisher:Basic Books (AZ)

Length:256 Pages

Weight:1.20 lbs.

Dimensions:1.0" x 6.4" x 9.6"

Customer Reviews

4 ratings

For anyone seeking to build a successful stock portfolio

Published by Thriftbooks.com User , 23 years ago

In The End Of Shareholder Value: Corporations At The Crossroads, Allan Kennedy persuasively maintains that managing businesses solely to get the stock price higher is bad for workers, customers, suppliers, and ultimately bad business for the stock holders as well. While for the few who hold the stock, and the fewer still who manage the company and then cash out when the stock price is high, the style of managing for stock price benefits, will invariably result in an erosion of company value with employees and shareholder being adversely affected under a short-term management practice and perspective. The End Of Shareholder Value is "must" reading for anyone seeking to build a successful stock portfolio through buying shares in any corporation regardless of size, past performance, or managerial reputation.

Interesting study of corporate evolution

Published by Thriftbooks.com User , 23 years ago

I'm not an economist and I don't have an MBA, but for the most part, I found this book to be easily understood and informative. I especially enjoyed the study of the three phases of the evolution of large companies, from family-derived to the greed merchants of the 1990's. Because I "cheated" and read the last couple of chapters first, I was concerned that Mr. Kennedy appeared to have a somewhat anti-business view of how to correct things (power to the people and all that). But I have to admit that his remedies do make a great deal of sense, and that it will take some real revolutionary changes to get us out of this mess we're in.I must say that, for the most part, big corporations (and I've worked with quite a few, as a customer, employee and supplier) do take advantage of the "other" stakeholders (employees, suppliers and customers!) and that, often, senior management is much more concerned with feathering their own personal nest than in doing the job that they're paid a lot of money to do. That's pretty frightening, because it's in the hands of these managers that the future of corporate America rests. I just hope that somehow we can get them to listen. I'd sure like to buy about fifty copies of this book and send it to some senior managers I know (anonomously, of course!)

A "must" for anyone building a successful stock portfolio.

Published by Thriftbooks.com User , 23 years ago

In The End Of Shareholder Value, Allan Kennedy persuasively maintains that managing businesses solely to get the stock price higher is bad for workers, customers, suppliers, and ultimately bad business for the stock holders as well. While for the few who hold the stock, and the fewer still who manage the company and then cash out when the stock price is high, the style of managing for stock price benefits, will invariably result in an erosion of company value with employees and shareholder being adversely affected under a short-term management practice and perspective. The End Of Shareholder Value is "must" reading for anyone seeking to build a successful stock portfolio through buying shares in any corporation regardless of size, past performance, or managerial reputation.

Anti-Greed Tract Favoring Balanced Stakeholder Rewards

Published by Thriftbooks.com User , 23 years ago

I agree with Allan Kennedy that companies would achieve much better results if they concerned themselves with providing all stakeholders (including employees, suppliers, government, and communities) with great results, not just shareholders.Where I disagree with his book is I think his argument is flawed on how he comes to this conclusion. Basically, he outlines the major ways that stakeholders can be shortchanged (putting employees through constant downsizing, with products that don't meet customer needs, too much pressure on suppliers to provide low prices, and reneging on deals with governments) and acts as though every company does all of these things non-stop. That's certainly the exception, not the rule, in my experience. He then places a lot of weight on the idea that because stock prices are so high now that companies cannot possibly hope to accelerate stock prices any more with the existing exploitive tools listed above. That seems like apples and oranges to me. I work with companies to help them improve stock price, and I don't know of any companies that are doing more than 20 percent of the things that could improve their stock price. I agree that stock prices may not go up a lot more for old economy companies, but the reason is that the managements don't know how to expand stock price any more, not that the stock prices could not be expanded further.Kennedy uses GE as an example and flatly sees no future stock-price improvement for that company. That seemed like a fallacious argument to me because partially breaking the company up with new equity securities that would have a higher multiple than the parent could easily double this company's valuation in just a few months. The company's e-commerce initiatives have enormous potential for a high and large valuation, for example. Our research with the most successful companies in expanding shareholder value shows that balanced benefits for all stakeholders is the best way to grow stock price. So even if you subscribe to the 'greed is good' school, you should share. The reason for this result is because cooperation from the other stakeholders adds value that allows the companies to grow faster and be more profitable. Kennedy missed that point, even though I have been publishing annual articles on this subject documenting this point for many years in Chief Executive Magazine and on our various Web sites. If you want to learn more about some of the flawed and stalled thinking that has emerged in some companies that subscribe to discounted cash flow stock-price valuation methods, you have found the right book. If you want to know what will be the best practices for rewarding all stakeholders in the future, this one has some of the vision but not all of the right stuff.