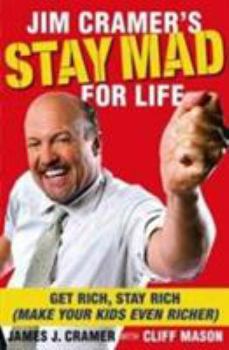

Jim Cramer's Stay Mad for Life: Get Rich, Stay Rich (Make Your Kids Even Richer)

Select Format

Select Condition

Book Overview

Jim Cramer, bestselling author and host of CNBC's Mad Money, has written the ultimate guide to lifetime investing for readers of any age. Whether you're a recent college grad trying to figure out how... This description may be from another edition of this product.

Format:Hardcover

Language:English

ISBN:1416558853

ISBN13:9781416558859

Release Date:December 2007

Publisher:Simon & Schuster

Length:269 Pages

Weight:1.18 lbs.

Dimensions:1.1" x 6.4" x 9.5"

Related Subjects

Business Business & Investing Economics Education & Reference Introduction InvestingCustomer Reviews

5 ratings

Jim Cramer's Stay Mad For Life: Get Rich, Stay Rich

Published by Thriftbooks.com User , 16 years ago

I read and used his first three books and started a new portfolio from scratch at the beginning of last year. I have a balanced ten stock portfolio that returned just over 20% last year and wish I had learned what he has taught years ago. This book is a useful and much needed addition to his library. This book addresses how to manage your retirement account in detail and gives specific investment recommendations for placing your money into. This is a must have book for anyone...especially for those who have other people manage their money. Buy it. Namaste, Brooks Helms

Cramer nailed the basics and gives timely advice

Published by Thriftbooks.com User , 16 years ago

Jim Cramer has really produced another great book. This one starts out as a personal finance book explaining how to budget and the importance of saving money in a retirement account each month. He advises to contribute whatever is needed into your 401K plan at work to get the match. (Most companies offer a 80%-100% return on your money off the top with the match). I can tell you from my experience that is the #1 reason I have a hefty net worth at 35 years old. Cramer then advises putting money beyond the match into an IRA for more investment options than the 401K offers. His advice is to put the money in an S & P index fund if your 401K does not offer excellent funds to invest in. He advises to never put this money in your company's stock, the risk is to great. Cramer explains bonds, bills, and treasuries in this book along with the percentage of your money to hold in them. You will see that he is much more aggressive with his recommendations for the percentage of your money to hold in stocks as you age. I agree with him. You will also learn Cramer's twenty new rules for investing. These rules are great for investors and traders. My favorite two are: 1. Don't let the market shake you out of a good long-term thesis. 2. Don't quit when you get back to even. You will learn the ten things pros do but amateurs get wrong. 1. Pros always have cash. 2. Pros don't worry about the quarterly report. 3. Pros try not to invest in things they don't know. 4. Pros recognize that everthing is not analyzable. 5. Pros want to know the downside, not the upside. (This one is excellent). 6. Pros always look, they never avert their eyes from a down turn. 7. Pros accept that not everything works at once. 8. Amateurs worry they are not making enough, pros worry they are making to much. (Which means taking on to much risk). 9. Pros do their homework. 10. Pros understand the upside, but know things can go wrong. Cramer picks out the five bull market sectors he believes have a long term upside. Aerospace and defense, agriculture, oil and oil service, minerals and mining, and infrastructure. Learn his theories on these markets and why he sees long term earnings increases. He also names twenty stocks that he believes are excellent long term investments. There are four of these that I also think will do outstanding in the coming years: Google, Pepsi, Boeing, and Caterpillar. Cramer finishs with the best guide to mutual funds I have ever seen, recommending 13 of the most outstanding funds out there. Judging them not only on there long term results but more importantly how they performed in the down years of 2000, 2001, and 2002. The true value of actively managed funds is the ability of the manager to protect you against the markets downside. If they can not do this it is better to just invest in a S & P index fund and beat 80% of actively managed funds and save the management fees. I can personally attest to making several thousand dollars following Jim Cramer, he proved

Where Ego and Genius Collide

Published by Thriftbooks.com User , 16 years ago

He says it in the intro: he may be teaching people how to invest because he is a nice guy OR he wants to be perceived as a nice guy. THat's the type of unabashed marketer Cramer is. Combined with his ego, that's one side of Cramer that shows up in all of his book, especially his latest- "Stay Mad". THe other side to Cramer is his smart investing sense. He takes positions long (like a good value investor) and he promotes individual knowledge about the stocks people invest on--a good bit of advice that alludes to my favorite social theories from the book The Wisdom of Crowds. Cramer purports that "anyone can beat any manager" (financial managers) and it's true. Most managers are looking to make the once in a lifetime pick that turns $3000 in a million instead of the commonplace investment that turns $10,000 into a $100,000. All good investment takes is homework, according to this book- and Cramer provides the first few lessons. Create a budget, save money, manage your own stocks (based on quarterly reports, earnings, and most important-personal knowledge of the stock). He hits on something I've always said- if you like a company enough to buy their products regularly- you probably should buy their stock. I did this with AAPL and have patting myself on the back ever since! The biggest problem is getting to a point where you can save and invest money. The budgeting mentioned in this book helps, but there are other clever ways to increase your personal profit (How to Take Advantage of the People Who Are Trying to Take Advantage of You: 50 Ways to Capitalize on the System).

Another Home Run

Published by Thriftbooks.com User , 16 years ago

I'm a longtime fan of Mad Money, and Cramer's made me some in the past. His new book is different from the last two, but it's just as entertaining with the same trademark Cramer style. I really liked his advice about 401(k) plans because I didn't have a clue about mine until I read this book. Cramer does a good job of making some boring personal finance subjects actually seem interesting. I guess if anyone could do it Cramer could. Fans of Real Money and Mad Money will especially appreciate his new rules based on managing his charitable trust, and his list of the differences between professional and amateur investors. At the end of the book he actually gives you a list of mutual funds that earned his seal of approval even though he never talks about that kind of thing on the show. Overall, if you like Cramer, you'll like the book, and if you wish Cramer would talk about more than just stocks, you'll absolutely love it.

Good suggestions in the book

Published by Thriftbooks.com User , 16 years ago

Its a good book. There is a section in there where Jim gives 20 points to what a Professional does versus what a amateur will do. For eg he devotes 5 pages as to why it's not a good idea to buy before earnings report. Why one must look beyond a quarter in holding a good stock. Some of the best returns are got when one holds for a long term a good quality stock till the technical's break down. The two chapters on rules is itself worth the money of the book and more if one wants to be in the game of a complicated mind game called stock market. Good luck to all!!